Trade Desk (NASDAQ:TTD - Get Free Report)'s stock had its "outperform" rating reaffirmed by research analysts at Wedbush in a report issued on Thursday,Benzinga reports. They presently have a $135.00 price objective on the technology company's stock. Wedbush's price objective points to a potential upside of 6.95% from the company's current price.

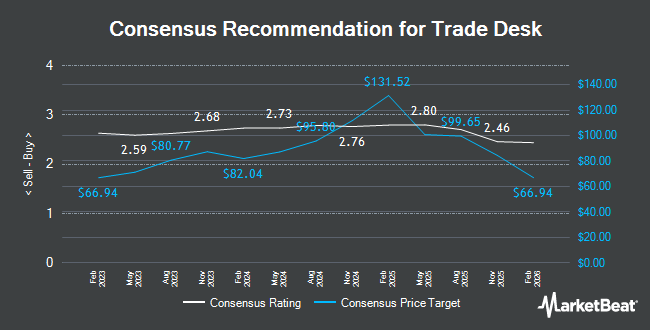

Several other equities analysts have also recently issued reports on the company. Loop Capital raised their price objective on Trade Desk from $120.00 to $145.00 and gave the stock a "buy" rating in a research note on Monday, November 11th. Macquarie increased their price objective on shares of Trade Desk from $133.00 to $150.00 and gave the stock an "outperform" rating in a research note on Friday, November 22nd. UBS Group lifted their target price on Trade Desk from $140.00 to $150.00 and gave the company a "buy" rating in a research note on Friday, November 8th. DA Davidson increased their price target on Trade Desk from $108.00 to $134.00 and gave the stock a "buy" rating in a research report on Monday, November 11th. Finally, KeyCorp boosted their price objective on Trade Desk from $115.00 to $130.00 and gave the company an "overweight" rating in a research report on Wednesday, October 9th. One analyst has rated the stock with a sell rating, six have given a hold rating and twenty-four have issued a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $127.07.

Get Our Latest Stock Analysis on Trade Desk

Trade Desk Trading Down 1.3 %

Trade Desk stock traded down $1.70 during midday trading on Thursday, hitting $126.23. The stock had a trading volume of 4,167,342 shares, compared to its average volume of 3,843,728. The business has a fifty day moving average price of $125.66 and a 200 day moving average price of $108.98. Trade Desk has a 12 month low of $61.47 and a 12 month high of $141.53. The stock has a market cap of $62.30 billion, a P/E ratio of 206.93, a P/E/G ratio of 6.00 and a beta of 1.43.

Insider Transactions at Trade Desk

In other Trade Desk news, CFO Laura Schenkein sold 25,000 shares of the firm's stock in a transaction dated Wednesday, October 9th. The stock was sold at an average price of $115.43, for a total transaction of $2,885,750.00. Following the transaction, the chief financial officer now directly owns 693,953 shares in the company, valued at $80,102,994.79. This trade represents a 3.48 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Jeffrey Terry Green sold 200,000 shares of the business's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $108.68, for a total value of $21,736,000.00. Following the completion of the sale, the chief executive officer now directly owns 565,180 shares of the company's stock, valued at $61,423,762.40. This represents a 26.14 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,128,938 shares of company stock valued at $125,534,054 in the last three months. Corporate insiders own 9.72% of the company's stock.

Hedge Funds Weigh In On Trade Desk

Institutional investors have recently modified their holdings of the company. Independent Solutions Wealth Management LLC increased its stake in shares of Trade Desk by 21.0% in the third quarter. Independent Solutions Wealth Management LLC now owns 64,358 shares of the technology company's stock worth $7,057,000 after purchasing an additional 11,181 shares during the period. Oddo BHF Asset Management Sas acquired a new stake in Trade Desk in the 3rd quarter valued at approximately $11,296,000. Franklin Resources Inc. increased its position in Trade Desk by 326.1% in the 3rd quarter. Franklin Resources Inc. now owns 509,495 shares of the technology company's stock worth $60,105,000 after buying an additional 389,917 shares during the period. Synovus Financial Corp acquired a new position in shares of Trade Desk during the third quarter worth approximately $245,000. Finally, Wilmington Savings Fund Society FSB bought a new stake in shares of Trade Desk in the third quarter valued at approximately $1,194,000. Institutional investors own 67.77% of the company's stock.

Trade Desk Company Profile

(

Get Free Report)

The Trade Desk, Inc operates as a technology company in the United States and internationally. The company offers a self-service cloud-based platform that allows buyers to plan, manage, optimize, and measure data-driven digital advertising campaigns across various ad formats and channels, including video, display, audio, digital-out-of-home, native, and social on various devices, such as computers, mobile devices, televisions, and streaming devices.

Featured Articles

Before you consider Trade Desk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trade Desk wasn't on the list.

While Trade Desk currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.