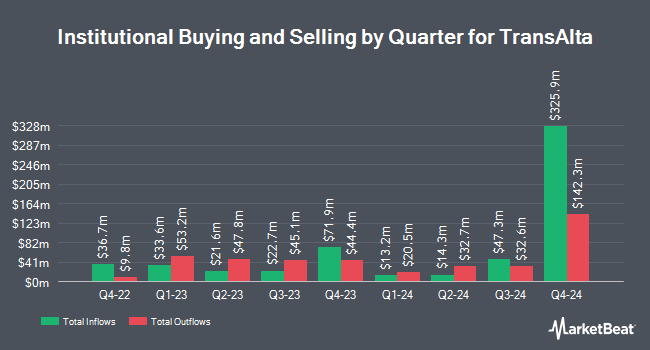

Clayton Partners LLC cut its position in TransAlta Co. (NYSE:TAC - Free Report) TSE: TA by 21.8% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 779,931 shares of the utilities provider's stock after selling 216,911 shares during the quarter. TransAlta accounts for 7.6% of Clayton Partners LLC's portfolio, making the stock its 2nd largest position. Clayton Partners LLC owned 0.26% of TransAlta worth $11,036,000 at the end of the most recent quarter.

A number of other large investors have also added to or reduced their stakes in TAC. Rubric Capital Management LP raised its holdings in TransAlta by 20.0% in the third quarter. Rubric Capital Management LP now owns 5,622,961 shares of the utilities provider's stock valued at $58,254,000 after acquiring an additional 935,803 shares in the last quarter. FMR LLC raised its stake in shares of TransAlta by 9.8% in the 3rd quarter. FMR LLC now owns 4,593,023 shares of the utilities provider's stock valued at $47,613,000 after purchasing an additional 408,184 shares in the last quarter. Wellington Management Group LLP acquired a new stake in TransAlta during the third quarter valued at approximately $998,000. Polar Asset Management Partners Inc. bought a new position in TransAlta during the third quarter worth $518,000. Finally, Public Employees Retirement System of Ohio bought a new position in shares of TransAlta in the 3rd quarter worth about $1,812,000. 59.00% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on TAC. Cibc World Mkts upgraded TransAlta from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, February 18th. Scotiabank lowered TransAlta from a "sector outperform" rating to a "sector perform" rating in a report on Thursday, January 23rd. CIBC raised shares of TransAlta from a "neutral" rating to an "outperformer" rating and reduced their price objective for the stock from $23.00 to $19.50 in a report on Tuesday, February 18th. Finally, StockNews.com cut shares of TransAlta from a "buy" rating to a "hold" rating in a research note on Friday, February 21st. Three analysts have rated the stock with a hold rating and one has given a strong buy rating to the stock. According to MarketBeat, TransAlta has an average rating of "Moderate Buy" and an average price target of $19.50.

Check Out Our Latest Report on TransAlta

TransAlta Price Performance

NYSE TAC traded down $0.02 on Thursday, reaching $9.78. 560,206 shares of the stock traded hands, compared to its average volume of 1,010,428. TransAlta Co. has a 12 month low of $5.94 and a 12 month high of $14.64. The company has a market cap of $2.91 billion, a price-to-earnings ratio of 23.84 and a beta of 0.89. The firm's fifty day simple moving average is $11.13 and its 200 day simple moving average is $11.15. The company has a quick ratio of 0.67, a current ratio of 0.74 and a debt-to-equity ratio of 2.94.

TransAlta (NYSE:TAC - Get Free Report) TSE: TA last announced its earnings results on Thursday, February 20th. The utilities provider reported ($0.16) earnings per share for the quarter, missing the consensus estimate of $0.12 by ($0.28). The firm had revenue of $484.60 million for the quarter. TransAlta had a net margin of 6.38% and a return on equity of 18.47%. As a group, research analysts predict that TransAlta Co. will post 0.41 EPS for the current fiscal year.

TransAlta Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 1st. Stockholders of record on Sunday, June 1st will be paid a $0.0458 dividend. The ex-dividend date is Friday, May 30th. This represents a $0.18 annualized dividend and a dividend yield of 1.87%. This is a boost from TransAlta's previous quarterly dividend of $0.04. TransAlta's payout ratio is currently 43.90%.

TransAlta Profile

(

Free Report)

TransAlta Corporation engages in the development, production, and sale of electric energy. It operates through Hydro, Wind and Solar, Gas, Energy Transition, and Energy Marketing segments. The Hydro segment holds interest of approximately 922 megawatts (MW) of owned hydroelectric generating capacity located in Alberta, British Columbia, and Ontario.

Read More

Before you consider TransAlta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransAlta wasn't on the list.

While TransAlta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.