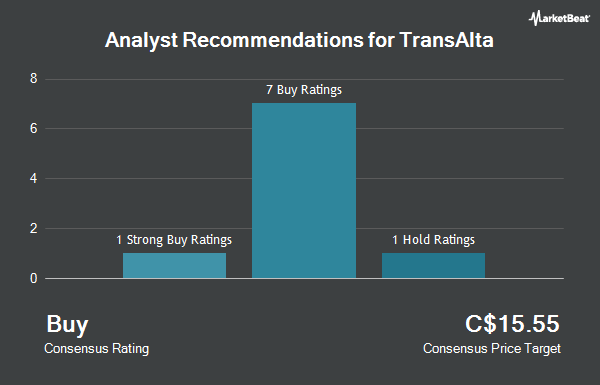

Shares of TransAlta Co. (TSE:TA - Get Free Report) NYSE: TAC have earned a consensus rating of "Moderate Buy" from the six brokerages that are currently covering the firm, Marketbeat Ratings reports. Two research analysts have rated the stock with a hold rating, three have given a buy rating and one has issued a strong buy rating on the company. The average 12 month target price among brokers that have covered the stock in the last year is C$17.71.

A number of equities research analysts recently weighed in on TA shares. Cibc World Mkts raised TransAlta from a "hold" rating to a "strong-buy" rating in a report on Tuesday, February 18th. TD Securities raised their target price on TransAlta from C$18.00 to C$19.00 and gave the company a "buy" rating in a research note on Tuesday, February 11th. CIBC reduced their price target on shares of TransAlta from C$19.50 to C$19.00 and set an "outperform" rating on the stock in a research report on Thursday. Finally, Scotiabank lowered their price objective on shares of TransAlta from C$21.00 to C$17.00 and set a "sector perform" rating for the company in a research report on Thursday, April 17th.

Check Out Our Latest Stock Analysis on TransAlta

Insider Buying and Selling

In related news, Senior Officer Joel E. Hunter acquired 45,000 shares of the firm's stock in a transaction that occurred on Thursday, February 27th. The stock was acquired at an average cost of C$14.99 per share, with a total value of C$674,752.50. Corporate insiders own 0.21% of the company's stock.

TransAlta Price Performance

TransAlta stock traded up C$0.29 during trading hours on Thursday, hitting C$12.47. 1,064,241 shares of the stock were exchanged, compared to its average volume of 2,110,005. TransAlta has a 12 month low of C$8.95 and a 12 month high of C$21.22. The business's 50-day moving average is C$13.34 and its two-hundred day moving average is C$15.56. The company has a debt-to-equity ratio of 229.66, a quick ratio of 0.62 and a current ratio of 0.74. The stock has a market capitalization of C$3.74 billion, a P/E ratio of 17.77, a P/E/G ratio of -0.07 and a beta of 0.93.

About TransAlta

(

Get Free ReportTransAlta is an independent power producer based in Alberta, Canada. The company operates a diverse and growing fleet of electrical power generation assets in Canada, the United States, and Australia consisting of hydro, wind, solar, battery storage, gas and energy transition facilities. The majority of the company's revenues are derived from the sale of generation capacity, electricity, thermal energy, environmental attributes, and byproducts of power generation.

See Also

Before you consider TransAlta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransAlta wasn't on the list.

While TransAlta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.