Transcontinental (TSE:TCL.A - Get Free Report) had its price target increased by analysts at CIBC from C$20.00 to C$21.00 in a research note issued on Monday,BayStreet.CA reports. CIBC's price objective would suggest a potential upside of 16.67% from the company's previous close.

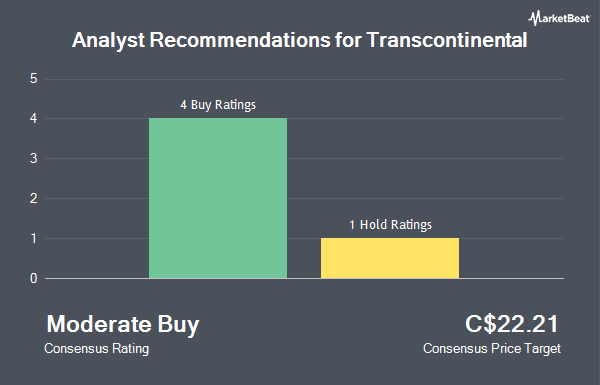

A number of other research firms have also recently issued reports on TCL.A. BMO Capital Markets lifted their price target on Transcontinental from C$18.00 to C$20.00 in a report on Friday. Royal Bank of Canada upped their target price on shares of Transcontinental from C$22.00 to C$23.00 in a research report on Tuesday, December 10th. National Bankshares increased their price target on shares of Transcontinental from C$21.00 to C$23.00 in a research note on Friday. Finally, Scotiabank boosted their price objective on shares of Transcontinental from C$19.50 to C$22.00 in a research report on Friday. One investment analyst has rated the stock with a hold rating and four have given a buy rating to the company. According to MarketBeat, Transcontinental has a consensus rating of "Moderate Buy" and an average target price of C$22.08.

Read Our Latest Analysis on TCL.A

Transcontinental Stock Performance

Transcontinental stock traded down C$0.08 during trading hours on Monday, hitting C$18.00. The stock had a trading volume of 192,341 shares, compared to its average volume of 152,575. Transcontinental has a fifty-two week low of C$13.10 and a fifty-two week high of C$18.85. The company has a market cap of C$1.28 billion, a PE ratio of 13.53, a price-to-earnings-growth ratio of 6.05 and a beta of 0.98. The company has a 50-day moving average of C$17.38 and a two-hundred day moving average of C$16.24. The company has a quick ratio of 1.09, a current ratio of 1.49 and a debt-to-equity ratio of 54.12.

About Transcontinental

(

Get Free Report)

Transcontinental Inc engages in flexible packaging business in Canada, the United States, Latin America, the United Kingdom, Australia, and New Zealand. It operates through three segments: Packaging, Printing, and Media. The Packaging segment engages in extrusion, lamination, printing, and converting activities, as well as offers flexible plastic and paper products, including rollstock, bags and pouches, coextruded films, shrink films and bags, and advanced coatings.

Recommended Stories

Before you consider Transcontinental, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transcontinental wasn't on the list.

While Transcontinental currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.