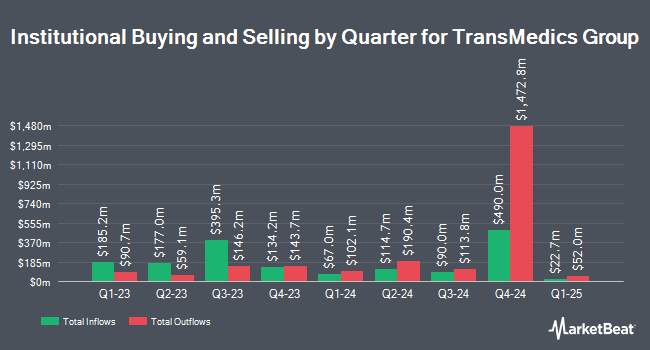

Baillie Gifford & Co. trimmed its holdings in shares of TransMedics Group, Inc. (NASDAQ:TMDX - Free Report) by 8.8% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 234,889 shares of the company's stock after selling 22,577 shares during the period. Baillie Gifford & Co. owned 0.70% of TransMedics Group worth $36,878,000 as of its most recent SEC filing.

Several other institutional investors have also recently bought and sold shares of TMDX. Vanguard Group Inc. raised its holdings in shares of TransMedics Group by 1.3% in the first quarter. Vanguard Group Inc. now owns 1,889,094 shares of the company's stock valued at $139,680,000 after buying an additional 23,979 shares during the last quarter. Driehaus Capital Management LLC grew its stake in shares of TransMedics Group by 15.8% during the second quarter. Driehaus Capital Management LLC now owns 1,486,073 shares of the company's stock valued at $223,832,000 after purchasing an additional 202,867 shares during the last quarter. Allspring Global Investments Holdings LLC increased its holdings in shares of TransMedics Group by 5.3% in the third quarter. Allspring Global Investments Holdings LLC now owns 599,116 shares of the company's stock valued at $94,061,000 after purchasing an additional 30,092 shares in the last quarter. Price T Rowe Associates Inc. MD raised its position in TransMedics Group by 8.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 297,324 shares of the company's stock worth $21,985,000 after purchasing an additional 22,223 shares during the last quarter. Finally, Vaughan Nelson Investment Management L.P. acquired a new position in TransMedics Group during the 2nd quarter worth $39,862,000. Institutional investors own 99.67% of the company's stock.

TransMedics Group Stock Up 1.4 %

Shares of TMDX traded up $1.32 on Wednesday, hitting $92.73. The company's stock had a trading volume of 1,798,126 shares, compared to its average volume of 961,323. The firm's fifty day moving average price is $129.09 and its 200-day moving average price is $139.89. TransMedics Group, Inc. has a fifty-two week low of $61.98 and a fifty-two week high of $177.37. The company has a quick ratio of 7.33, a current ratio of 8.20 and a debt-to-equity ratio of 2.42. The firm has a market capitalization of $3.11 billion, a price-to-earnings ratio of 103.60 and a beta of 2.08.

TransMedics Group (NASDAQ:TMDX - Get Free Report) last announced its earnings results on Monday, October 28th. The company reported $0.12 earnings per share for the quarter, missing analysts' consensus estimates of $0.29 by ($0.17). TransMedics Group had a return on equity of 18.74% and a net margin of 8.14%. The company had revenue of $108.76 million during the quarter, compared to analyst estimates of $115.00 million. During the same period in the previous year, the company posted ($0.12) earnings per share. TransMedics Group's revenue for the quarter was up 63.7% on a year-over-year basis. On average, equities research analysts expect that TransMedics Group, Inc. will post 1.07 EPS for the current year.

Insider Transactions at TransMedics Group

In related news, insider Nicholas Corcoran sold 10,000 shares of the firm's stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $176.02, for a total value of $1,760,200.00. Following the completion of the transaction, the insider now owns 21,105 shares of the company's stock, valued at approximately $3,714,902.10. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, insider Tamer I. Khayal sold 2,958 shares of the business's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $148.24, for a total transaction of $438,493.92. Following the transaction, the insider now directly owns 20,843 shares in the company, valued at approximately $3,089,766.32. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Nicholas Corcoran sold 10,000 shares of TransMedics Group stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $176.02, for a total transaction of $1,760,200.00. Following the completion of the transaction, the insider now directly owns 21,105 shares of the company's stock, valued at approximately $3,714,902.10. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 36,958 shares of company stock valued at $5,230,528 in the last ninety days. 7.00% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Several research firms have recently commented on TMDX. Needham & Company LLC lowered their target price on TransMedics Group from $208.00 to $109.00 and set a "buy" rating for the company in a research note on Tuesday, October 29th. JPMorgan Chase & Co. cut their target price on shares of TransMedics Group from $173.00 to $116.00 and set an "overweight" rating on the stock in a research report on Tuesday, October 29th. Oppenheimer lowered their price target on shares of TransMedics Group from $200.00 to $125.00 and set an "outperform" rating for the company in a research report on Tuesday, October 29th. Stephens increased their price objective on shares of TransMedics Group from $151.00 to $178.00 and gave the company an "overweight" rating in a report on Friday, August 2nd. Finally, Robert W. Baird lowered their target price on shares of TransMedics Group from $200.00 to $150.00 and set an "outperform" rating for the company in a report on Tuesday, October 29th. One equities research analyst has rated the stock with a hold rating, nine have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Buy" and a consensus price target of $144.80.

Check Out Our Latest Report on TMDX

TransMedics Group Company Profile

(

Free Report)

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.

Read More

Before you consider TransMedics Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransMedics Group wasn't on the list.

While TransMedics Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report