Transocean (NYSE:RIG - Get Free Report) is expected to be announcing its Q1 2025 earnings results after the market closes on Monday, April 28th. Analysts expect the company to announce earnings of ($0.12) per share and revenue of $884.92 million for the quarter.

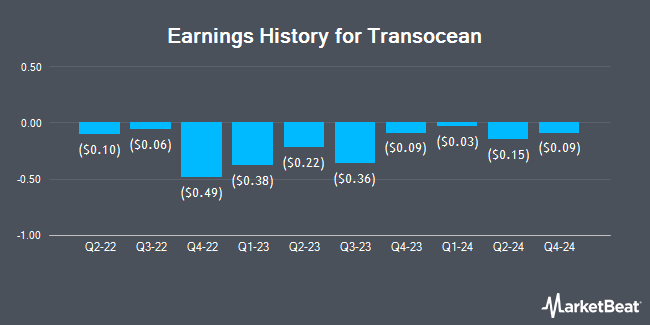

Transocean (NYSE:RIG - Get Free Report) last released its earnings results on Monday, February 17th. The offshore drilling services provider reported ($0.09) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.02 by ($0.11). The business had revenue of $952.00 million during the quarter, compared to the consensus estimate of $962.28 million. Transocean had a negative net margin of 14.53% and a negative return on equity of 0.52%. On average, analysts expect Transocean to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Transocean Trading Up 1.7 %

RIG opened at $2.33 on Friday. The company has a market cap of $2.06 billion, a P/E ratio of -3.19, a PEG ratio of 0.86 and a beta of 2.29. The company has a current ratio of 1.47, a quick ratio of 1.34 and a debt-to-equity ratio of 0.60. The company's 50 day moving average is $2.79 and its 200-day moving average is $3.60. Transocean has a 1-year low of $1.97 and a 1-year high of $6.38.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on RIG shares. Susquehanna cut their target price on shares of Transocean from $5.00 to $4.00 and set a "positive" rating on the stock in a research report on Monday, April 14th. Morgan Stanley reduced their price objective on Transocean from $5.00 to $4.00 and set an "equal weight" rating on the stock in a research report on Thursday, March 27th. TD Cowen lowered their target price on Transocean from $6.50 to $5.50 and set a "hold" rating for the company in a report on Wednesday, January 8th. Evercore ISI lowered Transocean from an "outperform" rating to an "in-line" rating and cut their price target for the company from $6.00 to $5.00 in a research note on Wednesday, January 15th. Finally, Barclays lowered their price objective on Transocean from $4.00 to $3.50 and set an "overweight" rating for the company in a research note on Monday, April 7th. One analyst has rated the stock with a sell rating, six have issued a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $4.59.

Read Our Latest Stock Report on Transocean

Insider Activity at Transocean

In other Transocean news, EVP Roderick James Mackenzie sold 22,000 shares of the company's stock in a transaction on Tuesday, February 11th. The shares were sold at an average price of $3.85, for a total transaction of $84,700.00. Following the sale, the executive vice president now owns 313,072 shares of the company's stock, valued at approximately $1,205,327.20. This represents a 6.57 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 13.16% of the stock is currently owned by company insiders.

About Transocean

(

Get Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.