Treasurer of the State of North Carolina reduced its holdings in Salesforce, Inc. (NYSE:CRM - Free Report) by 2.2% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 434,359 shares of the CRM provider's stock after selling 9,961 shares during the period. Salesforce makes up 0.6% of Treasurer of the State of North Carolina's holdings, making the stock its 24th biggest position. Treasurer of the State of North Carolina's holdings in Salesforce were worth $145,219,000 as of its most recent SEC filing.

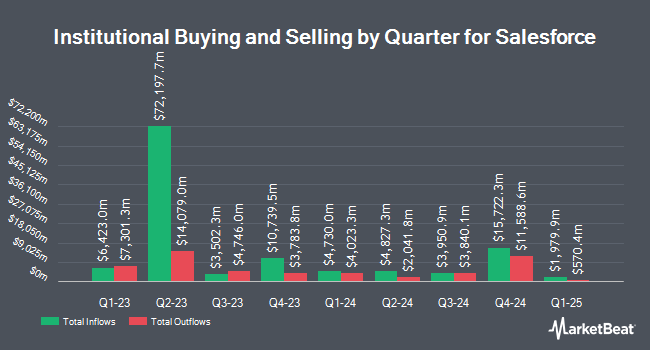

A number of other institutional investors and hedge funds have also recently bought and sold shares of CRM. Geode Capital Management LLC raised its stake in Salesforce by 0.9% during the fourth quarter. Geode Capital Management LLC now owns 19,955,353 shares of the CRM provider's stock worth $6,656,078,000 after purchasing an additional 175,035 shares during the period. Fisher Asset Management LLC raised its position in Salesforce by 1.4% in the fourth quarter. Fisher Asset Management LLC now owns 12,453,872 shares of the CRM provider's stock valued at $4,163,703,000 after purchasing an additional 177,321 shares during the period. Norges Bank purchased a new stake in Salesforce in the 4th quarter valued at about $3,599,867,000. Invesco Ltd. lifted its holdings in shares of Salesforce by 42.5% in the 4th quarter. Invesco Ltd. now owns 7,791,015 shares of the CRM provider's stock worth $2,604,770,000 after acquiring an additional 2,325,156 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA lifted its stake in Salesforce by 10.5% during the fourth quarter. Massachusetts Financial Services Co. MA now owns 6,593,295 shares of the CRM provider's stock worth $2,204,336,000 after purchasing an additional 628,593 shares in the last quarter. 80.43% of the stock is currently owned by institutional investors and hedge funds.

Salesforce Stock Performance

CRM stock traded down $0.27 during trading on Monday, hitting $254.73. The company had a trading volume of 2,435,636 shares, compared to its average volume of 6,806,766. Salesforce, Inc. has a 1-year low of $212.00 and a 1-year high of $369.00. The firm has a 50-day moving average price of $289.29 and a 200-day moving average price of $310.70. The company has a quick ratio of 1.11, a current ratio of 1.11 and a debt-to-equity ratio of 0.14. The firm has a market cap of $244.80 billion, a PE ratio of 41.90, a price-to-earnings-growth ratio of 2.58 and a beta of 1.38.

Salesforce Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, April 24th. Stockholders of record on Thursday, April 10th will be paid a dividend of $0.42 per share. This represents a $1.68 annualized dividend and a dividend yield of 0.66%. The ex-dividend date is Thursday, April 10th. This is a boost from Salesforce's previous quarterly dividend of $0.40. Salesforce's dividend payout ratio is 26.10%.

Insider Buying and Selling

In other news, CAO Sundeep G. Reddy sold 436 shares of the firm's stock in a transaction that occurred on Thursday, January 23rd. The stock was sold at an average price of $332.28, for a total value of $144,874.08. Following the completion of the sale, the chief accounting officer now directly owns 7,057 shares of the company's stock, valued at $2,344,899.96. This trade represents a 5.82 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Amy E. Weaver sold 897 shares of the company's stock in a transaction on Thursday, January 23rd. The stock was sold at an average price of $332.28, for a total value of $298,055.16. Following the transaction, the chief financial officer now directly owns 46,750 shares in the company, valued at $15,534,090. This represents a 1.88 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 45,660 shares of company stock valued at $14,095,336 over the last three months. 3.20% of the stock is currently owned by company insiders.

Analyst Ratings Changes

Several research analysts have recently commented on CRM shares. Loop Capital lowered their price objective on shares of Salesforce from $330.00 to $300.00 and set a "hold" rating for the company in a research note on Thursday, February 27th. TD Cowen upgraded shares of Salesforce from a "hold" rating to a "buy" rating and boosted their price target for the stock from $380.00 to $400.00 in a research note on Friday, January 17th. Citigroup reiterated a "buy" rating on shares of Salesforce in a research note on Wednesday, March 19th. Canaccord Genuity Group lowered their target price on Salesforce from $415.00 to $400.00 and set a "buy" rating for the company in a research note on Thursday, February 27th. Finally, BMO Capital Markets restated an "outperform" rating on shares of Salesforce in a report on Wednesday, March 19th. One research analyst has rated the stock with a sell rating, five have issued a hold rating, thirty-one have assigned a buy rating and five have given a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $361.42.

Check Out Our Latest Stock Report on Salesforce

Salesforce Profile

(

Free Report)

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

Featured Articles

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report