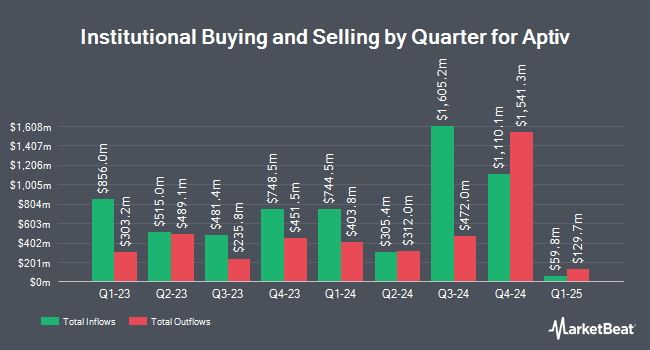

Tredje AP fonden decreased its position in shares of Aptiv PLC (NYSE:APTV - Free Report) by 50.0% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 21,116 shares of the auto parts company's stock after selling 21,115 shares during the quarter. Tredje AP fonden's holdings in Aptiv were worth $1,277,000 at the end of the most recent reporting period.

Several other hedge funds also recently modified their holdings of APTV. Brown Brothers Harriman & Co. lifted its holdings in Aptiv by 1,410.3% during the 3rd quarter. Brown Brothers Harriman & Co. now owns 438 shares of the auto parts company's stock worth $32,000 after buying an additional 409 shares during the period. Brooklyn Investment Group acquired a new position in Aptiv during the 3rd quarter worth about $43,000. CENTRAL TRUST Co lifted its holdings in Aptiv by 356.3% during the 4th quarter. CENTRAL TRUST Co now owns 867 shares of the auto parts company's stock worth $52,000 after buying an additional 677 shares during the period. Transamerica Financial Advisors Inc. acquired a new position in Aptiv during the 3rd quarter worth about $64,000. Finally, SRS Capital Advisors Inc. lifted its holdings in Aptiv by 93.1% during the 4th quarter. SRS Capital Advisors Inc. now owns 1,904 shares of the auto parts company's stock worth $115,000 after buying an additional 918 shares during the period. Institutional investors and hedge funds own 94.21% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have commented on the company. HSBC raised Aptiv from a "hold" rating to a "buy" rating and lifted their target price for the stock from $63.00 to $77.00 in a report on Tuesday, February 4th. Evercore ISI dropped their price objective on Aptiv from $105.00 to $95.00 and set an "outperform" rating on the stock in a research note on Monday, February 10th. Robert W. Baird raised Aptiv from a "neutral" rating to an "outperform" rating and boosted their price objective for the company from $75.00 to $82.00 in a research note on Monday, January 27th. Royal Bank of Canada boosted their price objective on Aptiv from $75.00 to $82.00 and gave the company an "outperform" rating in a research note on Friday, February 7th. Finally, Argus raised Aptiv to a "strong-buy" rating in a research note on Tuesday, February 11th. One research analyst has rated the stock with a sell rating, five have issued a hold rating, sixteen have assigned a buy rating and three have given a strong buy rating to the company. According to MarketBeat, Aptiv has an average rating of "Moderate Buy" and an average target price of $86.50.

Read Our Latest Research Report on Aptiv

Insider Activity at Aptiv

In related news, SVP Benjamin Lyon sold 14,568 shares of the company's stock in a transaction that occurred on Monday, March 10th. The stock was sold at an average price of $65.50, for a total value of $954,204.00. Following the transaction, the senior vice president now owns 125,237 shares in the company, valued at approximately $8,203,023.50. This represents a 10.42 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 0.34% of the stock is owned by company insiders.

Aptiv Stock Down 0.1 %

APTV traded down $0.07 during midday trading on Wednesday, reaching $62.75. 3,604,056 shares of the company were exchanged, compared to its average volume of 3,233,224. The company has a market cap of $14.40 billion, a price-to-earnings ratio of 9.12, a price-to-earnings-growth ratio of 0.62 and a beta of 1.78. The company has a debt-to-equity ratio of 0.87, a quick ratio of 1.07 and a current ratio of 1.53. The company's fifty day moving average price is $63.69 and its 200 day moving average price is $63.31. Aptiv PLC has a one year low of $51.47 and a one year high of $85.56.

Aptiv (NYSE:APTV - Get Free Report) last released its earnings results on Thursday, February 6th. The auto parts company reported $1.75 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.63 by $0.12. Aptiv had a return on equity of 15.63% and a net margin of 9.07%. As a group, analysts expect that Aptiv PLC will post 7.2 EPS for the current year.

About Aptiv

(

Free Report)

Aptiv PLC engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segments, Signal and Power Solutions, and Advanced Safety and User Experience.

Recommended Stories

Before you consider Aptiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aptiv wasn't on the list.

While Aptiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.