StockNews.com cut shares of TreeHouse Foods (NYSE:THS - Free Report) from a hold rating to a sell rating in a report published on Thursday morning.

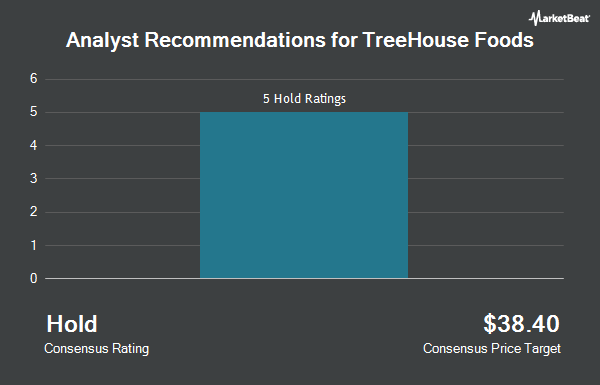

Several other equities analysts also recently issued reports on the company. Consumer Edge downgraded TreeHouse Foods from an "overweight" rating to an "equal weight" rating in a research report on Friday, November 15th. Mizuho boosted their price target on TreeHouse Foods from $37.00 to $40.00 and gave the stock a "neutral" rating in a research report on Monday, August 26th. Barclays lowered their price target on TreeHouse Foods from $39.00 to $32.00 and set an "equal weight" rating on the stock in a report on Wednesday, November 13th. Truist Financial cut their price objective on shares of TreeHouse Foods from $35.00 to $30.00 and set a "hold" rating on the stock in a research note on Wednesday, November 13th. Finally, Stifel Nicolaus decreased their target price on shares of TreeHouse Foods from $41.00 to $32.00 and set a "hold" rating for the company in a research report on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating and six have issued a hold rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $34.20.

View Our Latest Analysis on TreeHouse Foods

TreeHouse Foods Stock Up 0.4 %

NYSE THS traded up $0.14 on Thursday, hitting $34.02. 507,198 shares of the stock traded hands, compared to its average volume of 526,929. The company has a current ratio of 1.40, a quick ratio of 0.53 and a debt-to-equity ratio of 0.90. The stock has a 50-day moving average of $36.65 and a 200 day moving average of $38.02. TreeHouse Foods has a twelve month low of $28.04 and a twelve month high of $43.84. The company has a market capitalization of $1.74 billion, a P/E ratio of -72.38 and a beta of 0.23.

TreeHouse Foods (NYSE:THS - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The company reported $0.74 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.75 by ($0.01). The firm had revenue of $854.40 million for the quarter, compared to analyst estimates of $881.15 million. TreeHouse Foods had a negative net margin of 0.72% and a positive return on equity of 5.94%. The business's revenue was down 1.0% on a year-over-year basis. During the same period in the prior year, the company posted $0.57 earnings per share. As a group, analysts expect that TreeHouse Foods will post 1.96 earnings per share for the current fiscal year.

Institutional Trading of TreeHouse Foods

Several hedge funds have recently added to or reduced their stakes in THS. Canada Pension Plan Investment Board acquired a new position in shares of TreeHouse Foods during the second quarter valued at about $37,000. Signaturefd LLC grew its holdings in shares of TreeHouse Foods by 42.1% during the 3rd quarter. Signaturefd LLC now owns 999 shares of the company's stock worth $42,000 after purchasing an additional 296 shares in the last quarter. Innealta Capital LLC bought a new stake in shares of TreeHouse Foods during the second quarter valued at approximately $44,000. Rothschild Investment LLC bought a new position in TreeHouse Foods in the second quarter worth $67,000. Finally, KBC Group NV boosted its stake in TreeHouse Foods by 40.9% during the third quarter. KBC Group NV now owns 1,943 shares of the company's stock worth $82,000 after buying an additional 564 shares in the last quarter. Institutional investors own 99.81% of the company's stock.

About TreeHouse Foods

(

Get Free Report)

TreeHouse Foods, Inc manufactures and distributes private brands snacks and beverages in the United States and internationally. The company provides snacking products, such as crackers, pretzels, in-store bakery items, frozen griddle items, cookies, and candies; and beverage and drink mixes, including non-dairy creamer, coffee, broths/stocks, powdered beverages and other blends, tea, and ready-to-drink-beverages.

Recommended Stories

Before you consider TreeHouse Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TreeHouse Foods wasn't on the list.

While TreeHouse Foods currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.