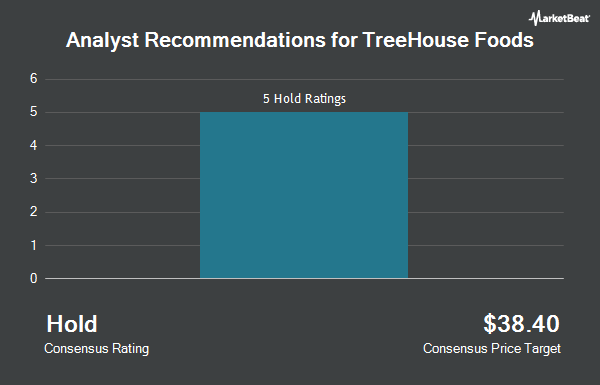

TreeHouse Foods (NYSE:THS - Get Free Report) was downgraded by analysts at Consumer Edge from an "overweight" rating to an "equal weight" rating in a research report issued on Friday, MarketBeat reports.

A number of other equities research analysts have also recently weighed in on the company. Stifel Nicolaus cut their price target on TreeHouse Foods from $41.00 to $32.00 and set a "hold" rating on the stock in a report on Wednesday. Barclays cut their target price on TreeHouse Foods from $39.00 to $32.00 and set an "equal weight" rating on the stock in a research note on Wednesday. Truist Financial cut their price objective on shares of TreeHouse Foods from $35.00 to $30.00 and set a "hold" rating on the stock in a research note on Wednesday. Mizuho increased their target price on shares of TreeHouse Foods from $37.00 to $40.00 and gave the company a "neutral" rating in a research report on Monday, August 26th. Finally, StockNews.com raised shares of TreeHouse Foods from a "sell" rating to a "hold" rating in a research note on Tuesday, August 6th. Seven equities research analysts have rated the stock with a hold rating, According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $34.20.

View Our Latest Research Report on TreeHouse Foods

TreeHouse Foods Stock Performance

THS stock traded down $0.87 during trading on Friday, hitting $32.41. 1,229,852 shares of the company's stock traded hands, compared to its average volume of 520,771. The stock has a fifty day moving average price of $39.69 and a two-hundred day moving average price of $38.24. The company has a quick ratio of 0.52, a current ratio of 1.40 and a debt-to-equity ratio of 0.90. TreeHouse Foods has a 52 week low of $28.04 and a 52 week high of $43.84. The stock has a market capitalization of $1.66 billion, a price-to-earnings ratio of -70.81 and a beta of 0.23.

TreeHouse Foods (NYSE:THS - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The company reported $0.74 earnings per share for the quarter, missing analysts' consensus estimates of $0.75 by ($0.01). TreeHouse Foods had a positive return on equity of 5.94% and a negative net margin of 0.72%. The company had revenue of $854.40 million for the quarter, compared to analyst estimates of $881.15 million. During the same quarter in the previous year, the company posted $0.57 earnings per share. The firm's revenue for the quarter was down 1.0% compared to the same quarter last year. As a group, equities analysts anticipate that TreeHouse Foods will post 2.34 EPS for the current fiscal year.

Insider Buying and Selling at TreeHouse Foods

In other news, EVP Kristy N. Waterman sold 3,000 shares of the company's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $42.34, for a total transaction of $127,020.00. Following the completion of the sale, the executive vice president now directly owns 20,784 shares of the company's stock, valued at $879,994.56. This represents a 12.61 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. 0.90% of the stock is owned by corporate insiders.

Institutional Trading of TreeHouse Foods

Several hedge funds and other institutional investors have recently modified their holdings of the business. Capital Research Global Investors boosted its stake in shares of TreeHouse Foods by 52.6% during the 1st quarter. Capital Research Global Investors now owns 950,372 shares of the company's stock valued at $37,017,000 after buying an additional 327,448 shares during the period. Legato Capital Management LLC boosted its position in TreeHouse Foods by 38.1% during the second quarter. Legato Capital Management LLC now owns 24,154 shares of the company's stock valued at $885,000 after purchasing an additional 6,666 shares during the last quarter. TD Asset Management Inc grew its stake in TreeHouse Foods by 7.3% in the second quarter. TD Asset Management Inc now owns 478,944 shares of the company's stock valued at $17,549,000 after purchasing an additional 32,600 shares in the last quarter. Harbor Capital Advisors Inc. increased its position in TreeHouse Foods by 68.2% in the 3rd quarter. Harbor Capital Advisors Inc. now owns 304,969 shares of the company's stock worth $12,803,000 after purchasing an additional 123,669 shares during the last quarter. Finally, Shapiro Capital Management LLC raised its stake in shares of TreeHouse Foods by 22.0% during the 2nd quarter. Shapiro Capital Management LLC now owns 1,587,415 shares of the company's stock worth $58,163,000 after purchasing an additional 286,770 shares in the last quarter. Institutional investors and hedge funds own 99.81% of the company's stock.

TreeHouse Foods Company Profile

(

Get Free Report)

TreeHouse Foods, Inc manufactures and distributes private brands snacks and beverages in the United States and internationally. The company provides snacking products, such as crackers, pretzels, in-store bakery items, frozen griddle items, cookies, and candies; and beverage and drink mixes, including non-dairy creamer, coffee, broths/stocks, powdered beverages and other blends, tea, and ready-to-drink-beverages.

Featured Articles

Before you consider TreeHouse Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TreeHouse Foods wasn't on the list.

While TreeHouse Foods currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.