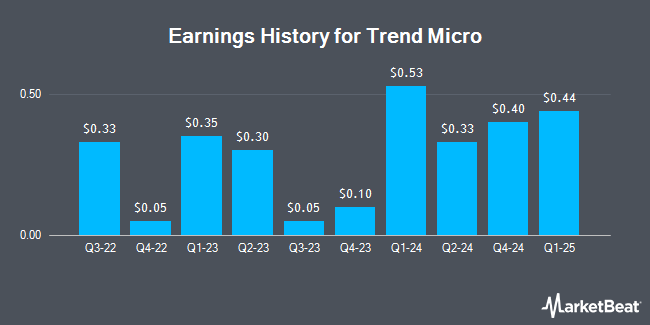

Trend Micro (OTCMKTS:TMICY - Get Free Report) released its quarterly earnings data on Tuesday. The technology company reported $0.40 EPS for the quarter, Zacks reports. Trend Micro had a net margin of 12.64% and a return on equity of 31.66%. The business had revenue of $459.42 million for the quarter, compared to analyst estimates of $448.97 million.

Trend Micro Stock Performance

TMICY stock traded down $2.33 during trading on Friday, hitting $74.47. The stock had a trading volume of 1,292 shares, compared to its average volume of 3,597. The company's 50 day moving average price is $58.52 and its two-hundred day moving average price is $56.98. Trend Micro has a 1-year low of $38.85 and a 1-year high of $78.94. The stock has a market cap of $10.49 billion, a price-to-earnings ratio of 43.55 and a beta of 0.65.

About Trend Micro

(

Get Free Report)

Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally. The company offers platforms, such as vision one platform, attack surface management, extended detection and response (XDR), cloud security, endpoint security, network security, email security, OT/ICS security, and threat intelligence.

Featured Articles

Before you consider Trend Micro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trend Micro wasn't on the list.

While Trend Micro currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.