Trex (NYSE:TREX - Get Free Report) had its price target cut by Bank of America from $85.00 to $79.00 in a note issued to investors on Tuesday,Benzinga reports. The brokerage presently has a "buy" rating on the construction company's stock. Bank of America's price target suggests a potential upside of 28.03% from the company's current price.

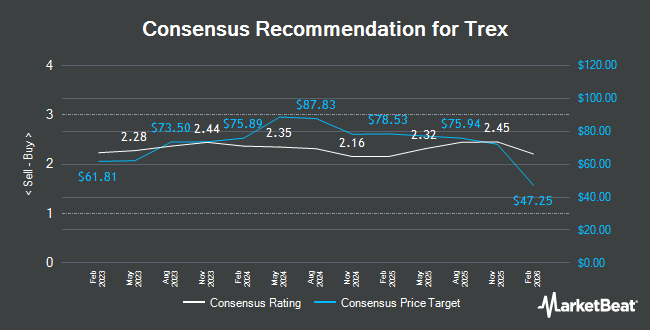

A number of other brokerages also recently issued reports on TREX. Barclays cut their price objective on shares of Trex from $68.00 to $67.00 and set an "underweight" rating for the company in a research report on Tuesday, October 29th. BMO Capital Markets upped their price target on Trex from $67.00 to $72.00 and gave the stock a "market perform" rating in a research report on Tuesday, October 29th. DA Davidson raised their price objective on Trex from $70.00 to $74.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 29th. Citigroup cut their price objective on Trex from $84.00 to $78.00 and set a "neutral" rating for the company in a research note on Monday, January 6th. Finally, Robert W. Baird raised their target price on shares of Trex from $70.00 to $78.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 29th. One research analyst has rated the stock with a sell rating, ten have given a hold rating and six have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $78.38.

Get Our Latest Research Report on TREX

Trex Price Performance

Trex stock traded up $1.38 during mid-day trading on Tuesday, reaching $61.71. 1,719,540 shares of the stock traded hands, compared to its average volume of 1,357,345. The stock has a market capitalization of $6.61 billion, a PE ratio of 28.18, a price-to-earnings-growth ratio of 2.51 and a beta of 1.51. The business's 50-day moving average is $69.13 and its 200-day moving average is $68.64. Trex has a 12-month low of $58.68 and a 12-month high of $100.77.

Trex (NYSE:TREX - Get Free Report) last issued its quarterly earnings data on Monday, February 24th. The construction company reported $0.09 earnings per share for the quarter, topping the consensus estimate of $0.04 by $0.05. The firm had revenue of $167.63 million for the quarter, compared to analysts' expectations of $160.54 million. Trex had a net margin of 20.23% and a return on equity of 28.89%. Equities analysts anticipate that Trex will post 2.04 EPS for the current fiscal year.

Insider Activity

In related news, Director Melkeya Mcduffie sold 1,420 shares of Trex stock in a transaction dated Friday, February 28th. The stock was sold at an average price of $61.88, for a total value of $87,869.60. Following the completion of the transaction, the director now owns 1,705 shares in the company, valued at approximately $105,505.40. This trade represents a 45.44 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Company insiders own 0.71% of the company's stock.

Institutional Trading of Trex

A number of institutional investors have recently bought and sold shares of TREX. Alliancebernstein L.P. lifted its stake in shares of Trex by 54.5% during the 4th quarter. Alliancebernstein L.P. now owns 10,819,326 shares of the construction company's stock worth $746,858,000 after acquiring an additional 3,818,025 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its position in Trex by 463.7% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 3,134,849 shares of the construction company's stock valued at $216,400,000 after acquiring an additional 2,578,734 shares in the last quarter. AustralianSuper Pty Ltd purchased a new position in Trex in the fourth quarter valued at about $110,414,000. Anomaly Capital Management LP grew its position in shares of Trex by 228.2% in the 4th quarter. Anomaly Capital Management LP now owns 1,512,783 shares of the construction company's stock worth $104,427,000 after buying an additional 1,051,888 shares during the last quarter. Finally, Wasatch Advisors LP increased its position in shares of Trex by 33.2% during the third quarter. Wasatch Advisors LP now owns 4,076,408 shares of the construction company's stock worth $271,407,000 after purchasing an additional 1,015,516 shares in the last quarter. 95.96% of the stock is currently owned by institutional investors.

Trex Company Profile

(

Get Free Report)

Trex Company, Inc manufactures and distributes composite decking, railing, and outdoor living products and accessories for residential and commercial markets in the United States. It offers decking products and accessories under the names Trex Transcend, Trex Select, Trex Signature, Trex Transcend Lineage, and Trex Enhance for protection against fading, staining, mold, and scratching; Trex Hideaway, a hidden fastening system; and Trex DeckLighting, a LED dimmable deck lighting for use on posts, floors, and steps.

See Also

Before you consider Trex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trex wasn't on the list.

While Trex currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.