Trexquant Investment LP boosted its holdings in shares of Sensient Technologies Co. (NYSE:SXT - Free Report) by 165.6% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 38,193 shares of the specialty chemicals company's stock after purchasing an additional 23,813 shares during the period. Trexquant Investment LP owned about 0.09% of Sensient Technologies worth $2,722,000 as of its most recent SEC filing.

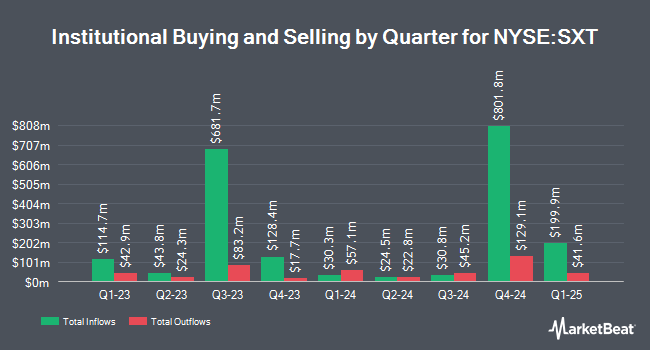

A number of other institutional investors also recently added to or reduced their stakes in SXT. Kohmann Bosshard Financial Services LLC bought a new position in shares of Sensient Technologies during the 4th quarter worth approximately $25,000. Jones Financial Companies Lllp raised its stake in Sensient Technologies by 18,766.7% during the fourth quarter. Jones Financial Companies Lllp now owns 566 shares of the specialty chemicals company's stock worth $40,000 after acquiring an additional 563 shares in the last quarter. R Squared Ltd bought a new position in shares of Sensient Technologies during the fourth quarter valued at $65,000. Smartleaf Asset Management LLC boosted its stake in shares of Sensient Technologies by 152.4% in the 4th quarter. Smartleaf Asset Management LLC now owns 1,123 shares of the specialty chemicals company's stock valued at $80,000 after purchasing an additional 678 shares in the last quarter. Finally, KBC Group NV grew its holdings in shares of Sensient Technologies by 77.3% in the 4th quarter. KBC Group NV now owns 1,787 shares of the specialty chemicals company's stock worth $127,000 after purchasing an additional 779 shares during the last quarter. 90.86% of the stock is owned by institutional investors and hedge funds.

Sensient Technologies Price Performance

SXT stock traded up $1.29 during midday trading on Friday, reaching $74.00. 315,464 shares of the company's stock traded hands, compared to its average volume of 197,579. The company has a quick ratio of 1.34, a current ratio of 3.55 and a debt-to-equity ratio of 0.58. The company has a market cap of $3.14 billion, a price-to-earnings ratio of 25.17 and a beta of 0.63. The company has a 50-day simple moving average of $72.75 and a two-hundred day simple moving average of $74.85. Sensient Technologies Co. has a 1-year low of $66.15 and a 1-year high of $82.99.

Sensient Technologies (NYSE:SXT - Get Free Report) last announced its earnings results on Friday, February 14th. The specialty chemicals company reported $0.65 earnings per share for the quarter, beating analysts' consensus estimates of $0.64 by $0.01. Sensient Technologies had a return on equity of 11.93% and a net margin of 8.01%. The company had revenue of $376.40 million during the quarter, compared to analyst estimates of $375.10 million. During the same period last year, the company posted $0.51 earnings per share. The firm's quarterly revenue was up 7.8% compared to the same quarter last year. On average, analysts anticipate that Sensient Technologies Co. will post 3.1 earnings per share for the current year.

Sensient Technologies Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, March 3rd. Stockholders of record on Tuesday, February 4th were given a dividend of $0.41 per share. The ex-dividend date of this dividend was Tuesday, February 4th. This represents a $1.64 dividend on an annualized basis and a dividend yield of 2.22%. Sensient Technologies's payout ratio is 55.78%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered shares of Sensient Technologies from a "buy" rating to a "hold" rating in a research report on Saturday, March 22nd.

View Our Latest Research Report on Sensient Technologies

Sensient Technologies Company Profile

(

Free Report)

Sensient Technologies Corporation, together with its subsidiaries, develops, manufactures, and markets colors, flavors, and other specialty ingredients in North America, Europe, Asia, Australia, South America, and Africa. The company offers flavor-delivery systems, and compounded and blended products; ingredient products, such as essential oils, natural and synthetic flavors, and natural extracts; and chili powder, paprika, and chili pepper, as well as dehydrated vegetables comprising parsley, celery, and spinach to the food, beverage, and personal care industries.

See Also

Before you consider Sensient Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensient Technologies wasn't on the list.

While Sensient Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.