Trexquant Investment LP raised its stake in shares of Under Armour, Inc. (NYSE:UAA - Free Report) by 179.7% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 612,159 shares of the company's stock after purchasing an additional 393,330 shares during the period. Trexquant Investment LP owned 0.14% of Under Armour worth $5,069,000 at the end of the most recent quarter.

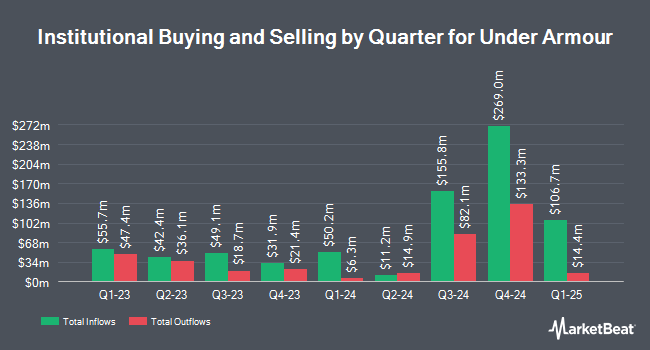

A number of other institutional investors have also recently made changes to their positions in UAA. Geode Capital Management LLC lifted its stake in shares of Under Armour by 0.3% in the fourth quarter. Geode Capital Management LLC now owns 2,890,105 shares of the company's stock worth $23,940,000 after acquiring an additional 9,024 shares during the period. National Bank of Canada FI boosted its position in Under Armour by 273.7% during the fourth quarter. National Bank of Canada FI now owns 140,911 shares of the company's stock valued at $1,167,000 after acquiring an additional 103,208 shares during the last quarter. Brown Brothers Harriman & Co. lifted its stake in shares of Under Armour by 50.1% in the 4th quarter. Brown Brothers Harriman & Co. now owns 50,051 shares of the company's stock valued at $414,000 after purchasing an additional 16,717 shares during the period. Norges Bank bought a new position in shares of Under Armour during the 4th quarter worth approximately $11,151,000. Finally, JPMorgan Chase & Co. lifted its position in shares of Under Armour by 36.5% during the 4th quarter. JPMorgan Chase & Co. now owns 554,525 shares of the company's stock valued at $4,591,000 after acquiring an additional 148,280 shares during the period. Institutional investors own 34.58% of the company's stock.

Under Armour Stock Performance

NYSE UAA traded down $0.60 during trading on Thursday, hitting $5.03. 7,915,644 shares of the company's stock traded hands, compared to its average volume of 11,729,397. The business has a 50 day moving average of $6.75 and a 200-day moving average of $8.15. Under Armour, Inc. has a 12-month low of $4.78 and a 12-month high of $11.89. The company has a debt-to-equity ratio of 0.30, a quick ratio of 1.19 and a current ratio of 2.01. The stock has a market capitalization of $2.16 billion, a price-to-earnings ratio of -17.47 and a beta of 1.49.

Under Armour (NYSE:UAA - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The company reported $0.08 EPS for the quarter, topping analysts' consensus estimates of $0.03 by $0.05. Under Armour had a positive return on equity of 11.03% and a negative net margin of 2.39%. During the same period last year, the company earned $0.19 earnings per share. As a group, equities research analysts anticipate that Under Armour, Inc. will post 0.3 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several analysts have recently commented on the company. StockNews.com upgraded Under Armour from a "sell" rating to a "hold" rating in a research note on Thursday, March 20th. Guggenheim restated a "neutral" rating on shares of Under Armour in a report on Friday, February 7th. Needham & Company LLC reiterated a "hold" rating on shares of Under Armour in a report on Friday, February 7th. Stifel Nicolaus lowered their price objective on shares of Under Armour from $13.00 to $11.00 and set a "buy" rating on the stock in a report on Thursday. Finally, Morgan Stanley reiterated an "underweight" rating and set a $4.00 price objective on shares of Under Armour in a report on Friday, December 13th. Three equities research analysts have rated the stock with a sell rating, fifteen have assigned a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $9.12.

View Our Latest Stock Report on Under Armour

About Under Armour

(

Free Report)

Under Armour, Inc, together with its subsidiaries, engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth. The company provides its apparel in compression, fitted, and loose fit types. It also offers footwear products for running, training, basketball, cleated sports, recovery, and outdoor applications.

Further Reading

Before you consider Under Armour, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Under Armour wasn't on the list.

While Under Armour currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.