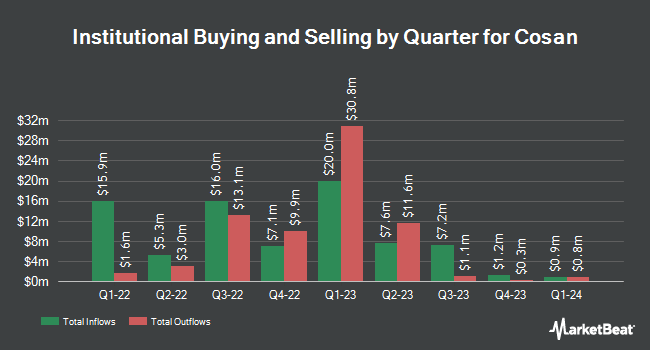

Trexquant Investment LP raised its position in Cosan S.A. (NYSE:CSAN - Free Report) by 1,909.9% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 215,801 shares of the company's stock after buying an additional 205,064 shares during the period. Trexquant Investment LP's holdings in Cosan were worth $1,174,000 at the end of the most recent reporting period.

Several other large investors also recently bought and sold shares of CSAN. PNC Financial Services Group Inc. grew its holdings in Cosan by 181.4% in the 4th quarter. PNC Financial Services Group Inc. now owns 9,790 shares of the company's stock valued at $53,000 after buying an additional 6,311 shares in the last quarter. PDS Planning Inc acquired a new position in Cosan in the 4th quarter valued at about $58,000. FMR LLC boosted its position in Cosan by 114.3% in the 3rd quarter. FMR LLC now owns 10,829 shares of the company's stock valued at $104,000 after buying an additional 5,775 shares during the period. Caprock Group LLC acquired a new position in Cosan during the 4th quarter worth $61,000. Finally, Savant Capital LLC purchased a new stake in shares of Cosan during the fourth quarter worth approximately $63,000.

Cosan Stock Up 0.1 %

Shares of Cosan stock traded up $0.01 during trading hours on Wednesday, hitting $4.74. The company had a trading volume of 266,491 shares, compared to its average volume of 764,451. Cosan S.A. has a twelve month low of $4.31 and a twelve month high of $11.75. The company has a market cap of $2.21 billion, a P/E ratio of 3.57, a price-to-earnings-growth ratio of 3.94 and a beta of 1.11. The company has a debt-to-equity ratio of 1.31, a current ratio of 1.86 and a quick ratio of 1.73. The company's 50-day moving average is $5.09 and its two-hundred day moving average is $6.27.

Wall Street Analysts Forecast Growth

Separately, Citigroup reissued a "buy" rating and issued a $19.00 target price on shares of Cosan in a report on Monday, December 23rd.

Read Our Latest Stock Report on CSAN

Cosan Company Profile

(

Free Report)

Cosan SA engages in the fuel distribution business. It operates through Raízen, Compass, Moove, Rumo, and Radar segments. The company's Raízen segment engages in the production, commercialization, origination, and trading of ethanol, bioenergy, renewable sources, and sugar; trading and resale of electricity; and distribution and commercialization of fuels and lubricants.

Further Reading

Before you consider Cosan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cosan wasn't on the list.

While Cosan currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.