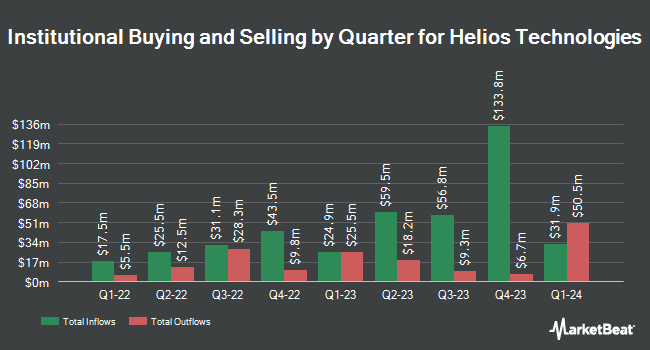

Trexquant Investment LP bought a new position in shares of Helios Technologies, Inc. (NASDAQ:HLIO - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the SEC. The fund bought 17,455 shares of the company's stock, valued at approximately $779,000. Trexquant Investment LP owned approximately 0.05% of Helios Technologies at the end of the most recent reporting period.

A number of other large investors have also recently made changes to their positions in the company. Signaturefd LLC boosted its stake in Helios Technologies by 71.8% in the fourth quarter. Signaturefd LLC now owns 687 shares of the company's stock valued at $31,000 after acquiring an additional 287 shares in the last quarter. US Bancorp DE increased its position in Helios Technologies by 321.2% during the 4th quarter. US Bancorp DE now owns 6,705 shares of the company's stock worth $299,000 after purchasing an additional 5,113 shares during the period. Empower Advisory Group LLC raised its position in Helios Technologies by 10.0% in the fourth quarter. Empower Advisory Group LLC now owns 6,765 shares of the company's stock worth $302,000 after acquiring an additional 615 shares in the last quarter. Ameritas Advisory Services LLC acquired a new position in shares of Helios Technologies during the 4th quarter worth $315,000. Finally, KLP Kapitalforvaltning AS acquired a new stake in shares of Helios Technologies in the fourth quarter valued at about $330,000. 94.72% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Separately, Stifel Nicolaus dropped their price objective on shares of Helios Technologies from $58.00 to $35.00 and set a "buy" rating for the company in a research note on Monday.

Get Our Latest Stock Report on Helios Technologies

Helios Technologies Trading Up 0.1 %

HLIO traded up $0.03 during trading on Tuesday, hitting $26.72. The company's stock had a trading volume of 270,061 shares, compared to its average volume of 199,234. Helios Technologies, Inc. has a twelve month low of $24.76 and a twelve month high of $57.29. The firm's 50 day moving average price is $35.42 and its 200-day moving average price is $43.64. The company has a debt-to-equity ratio of 0.52, a current ratio of 3.03 and a quick ratio of 1.54. The stock has a market cap of $889.50 million, a PE ratio of 23.64 and a beta of 1.03.

Helios Technologies Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 22nd. Stockholders of record on Friday, April 4th will be paid a dividend of $0.09 per share. This represents a $0.36 dividend on an annualized basis and a dividend yield of 1.35%. The ex-dividend date of this dividend is Friday, April 4th. Helios Technologies's dividend payout ratio is currently 30.77%.

Helios Technologies declared that its board has approved a share repurchase program on Monday, February 24th that permits the company to repurchase $100.00 million in outstanding shares. This repurchase authorization permits the company to repurchase up to 7.8% of its stock through open market purchases. Stock repurchase programs are generally an indication that the company's board of directors believes its stock is undervalued.

About Helios Technologies

(

Free Report)

Helios Technologies, Inc, together with its subsidiaries, provides engineered motion control and electronic control technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company operates in two segments, Hydraulics and Electronics. The Hydraulics segment offers cartridge valve technology products to control rates and direction of fluid flow, and to regulate and control pressures for industrial and mobile applications; hydraulic quick release coupling solutions for the agriculture, construction equipment, and industrial markets; motion control technology and fluid conveyance technology; cartridge valve technology; engineered solutions for machine users, manufacturers, or designers.

See Also

Before you consider Helios Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helios Technologies wasn't on the list.

While Helios Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.