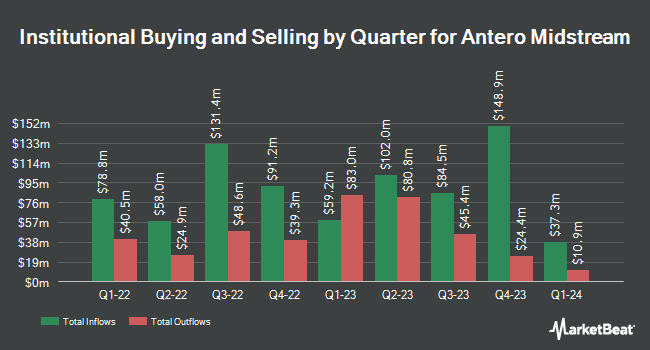

Trexquant Investment LP cut its position in shares of Antero Midstream Co. (NYSE:AM - Free Report) by 39.3% in the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund owned 283,203 shares of the pipeline company's stock after selling 183,087 shares during the quarter. Trexquant Investment LP owned 0.06% of Antero Midstream worth $4,274,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently bought and sold shares of the company. Geode Capital Management LLC grew its position in shares of Antero Midstream by 0.4% in the fourth quarter. Geode Capital Management LLC now owns 6,106,502 shares of the pipeline company's stock valued at $92,174,000 after purchasing an additional 25,001 shares during the last quarter. Franklin Resources Inc. grew its holdings in Antero Midstream by 18.5% during the 4th quarter. Franklin Resources Inc. now owns 251,813 shares of the pipeline company's stock valued at $3,800,000 after buying an additional 39,340 shares during the last quarter. O Shaughnessy Asset Management LLC purchased a new position in Antero Midstream during the fourth quarter worth $163,000. Brandywine Global Investment Management LLC raised its holdings in shares of Antero Midstream by 36.9% in the fourth quarter. Brandywine Global Investment Management LLC now owns 692,373 shares of the pipeline company's stock worth $10,448,000 after acquiring an additional 186,693 shares during the last quarter. Finally, Brown Brothers Harriman & Co. purchased a new stake in shares of Antero Midstream in the fourth quarter valued at $119,000. 53.97% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on the stock. StockNews.com raised shares of Antero Midstream from a "hold" rating to a "buy" rating in a research note on Thursday, April 3rd. Wells Fargo & Company lifted their price objective on Antero Midstream from $16.00 to $17.00 and gave the company an "overweight" rating in a research report on Tuesday, February 18th.

Read Our Latest Report on AM

Antero Midstream Trading Down 3.3 %

Shares of AM stock traded down $0.54 on Thursday, reaching $15.77. 685,954 shares of the stock were exchanged, compared to its average volume of 3,641,217. Antero Midstream Co. has a 1-year low of $13.12 and a 1-year high of $18.49. The stock has a market cap of $7.55 billion, a P/E ratio of 19.03 and a beta of 1.99. The company has a quick ratio of 1.17, a current ratio of 1.17 and a debt-to-equity ratio of 1.47. The firm has a 50 day moving average of $16.84 and a two-hundred day moving average of $15.90.

Antero Midstream (NYSE:AM - Get Free Report) last issued its earnings results on Wednesday, February 12th. The pipeline company reported $0.23 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.24 by ($0.01). Antero Midstream had a return on equity of 18.82% and a net margin of 36.24%. On average, research analysts anticipate that Antero Midstream Co. will post 0.95 EPS for the current year.

Antero Midstream Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, February 12th. Stockholders of record on Wednesday, January 29th were paid a dividend of $0.225 per share. The ex-dividend date was Wednesday, January 29th. This represents a $0.90 dividend on an annualized basis and a dividend yield of 5.71%. Antero Midstream's dividend payout ratio is currently 108.43%.

Antero Midstream Company Profile

(

Free Report)

Antero Midstream Corporation owns, operates, and develops midstream energy assets in the Appalachian Basin. It operates in two segments, Gathering and Processing, and Water Handling. The Gathering and Processing segment includes a network of gathering pipelines and compressor stations that collects and processes production from Antero Resources' wells in West Virginia and Ohio.

See Also

Before you consider Antero Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Midstream wasn't on the list.

While Antero Midstream currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn how options trading can help you navigate market volatility, manage risk, and maximize returns with MarketBeat's "Unlock the Potential in Options Trading." Click the link below to have this special report delivered to your inbox.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.