Trexquant Investment LP increased its position in shares of John B. Sanfilippo & Son, Inc. (NASDAQ:JBSS - Free Report) by 54.9% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 25,025 shares of the company's stock after acquiring an additional 8,869 shares during the quarter. Trexquant Investment LP owned approximately 0.21% of John B. Sanfilippo & Son worth $2,180,000 as of its most recent filing with the Securities and Exchange Commission.

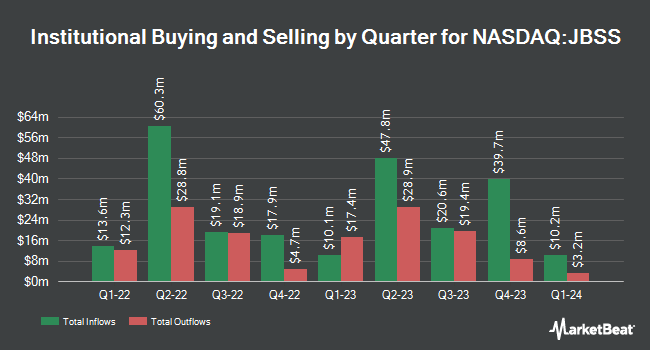

A number of other hedge funds have also recently modified their holdings of the company. Geode Capital Management LLC boosted its holdings in John B. Sanfilippo & Son by 1.0% in the 4th quarter. Geode Capital Management LLC now owns 217,294 shares of the company's stock valued at $18,932,000 after purchasing an additional 2,225 shares during the last quarter. Norges Bank acquired a new position in John B. Sanfilippo & Son in the fourth quarter valued at approximately $2,814,000. KLP Kapitalforvaltning AS purchased a new position in John B. Sanfilippo & Son in the fourth quarter worth approximately $139,000. Quantbot Technologies LP grew its position in John B. Sanfilippo & Son by 28.5% in the fourth quarter. Quantbot Technologies LP now owns 5,428 shares of the company's stock worth $473,000 after acquiring an additional 1,205 shares during the period. Finally, Semanteon Capital Management LP acquired a new stake in John B. Sanfilippo & Son during the fourth quarter worth $872,000. Hedge funds and other institutional investors own 70.64% of the company's stock.

John B. Sanfilippo & Son Trading Down 0.4 %

Shares of John B. Sanfilippo & Son stock traded down $0.28 during trading hours on Monday, hitting $67.06. The company's stock had a trading volume of 1,956 shares, compared to its average volume of 73,319. The stock has a market cap of $780.47 million, a price-to-earnings ratio of 16.08 and a beta of 0.29. The company has a debt-to-equity ratio of 0.02, a quick ratio of 0.67 and a current ratio of 2.04. John B. Sanfilippo & Son, Inc. has a twelve month low of $65.29 and a twelve month high of $105.63. The firm has a fifty day moving average of $70.70 and a 200-day moving average of $81.85.

John B. Sanfilippo & Son (NASDAQ:JBSS - Get Free Report) last posted its earnings results on Wednesday, January 29th. The company reported $1.16 EPS for the quarter. John B. Sanfilippo & Son had a net margin of 4.36% and a return on equity of 15.22%.

About John B. Sanfilippo & Son

(

Free Report)

John B. Sanfilippo & Son, Inc engages in the processing and distribution of nuts and nut-related products. It offers peanuts, pecans, cashews, walnuts, almonds, and other nuts under the brands of Fisher, Orchard Valley Harvest, Squirrel Brand, and Southern Style Nuts. The company was founded by Gaspare Sanfilippo and John B.

Read More

Before you consider John B. Sanfilippo & Son, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and John B. Sanfilippo & Son wasn't on the list.

While John B. Sanfilippo & Son currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.