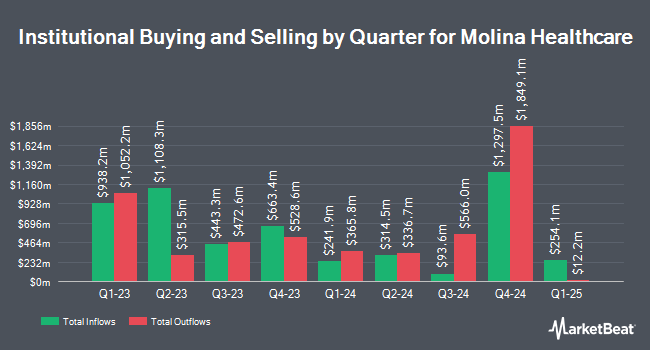

Trexquant Investment LP cut its holdings in shares of Molina Healthcare, Inc. (NYSE:MOH - Free Report) by 79.1% during the 4th quarter, according to its most recent Form 13F filing with the SEC. The firm owned 4,058 shares of the company's stock after selling 15,349 shares during the period. Trexquant Investment LP's holdings in Molina Healthcare were worth $1,181,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Tributary Capital Management LLC grew its holdings in Molina Healthcare by 76.1% in the fourth quarter. Tributary Capital Management LLC now owns 4,190 shares of the company's stock worth $1,219,000 after purchasing an additional 1,811 shares during the period. Everence Capital Management Inc. purchased a new stake in Molina Healthcare during the fourth quarter valued at $544,000. Smartleaf Asset Management LLC grew its position in Molina Healthcare by 123.9% during the fourth quarter. Smartleaf Asset Management LLC now owns 347 shares of the company's stock valued at $100,000 after buying an additional 192 shares during the period. SYM FINANCIAL Corp purchased a new position in Molina Healthcare during the fourth quarter valued at approximately $249,000. Finally, Oddo BHF Asset Management Sas bought a new position in shares of Molina Healthcare during the 3rd quarter valued at about $2,947,000. 98.50% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of equities analysts recently issued reports on MOH shares. Stephens restated an "equal weight" rating and set a $345.00 price objective on shares of Molina Healthcare in a report on Thursday, February 6th. JPMorgan Chase & Co. reissued a "neutral" rating and issued a $350.00 price objective (down previously from $378.00) on shares of Molina Healthcare in a research note on Tuesday, December 17th. Barclays decreased their price target on shares of Molina Healthcare from $372.00 to $339.00 and set an "equal weight" rating for the company in a research report on Friday, February 7th. Robert W. Baird reiterated a "neutral" rating and set a $375.00 price objective (up from $331.00) on shares of Molina Healthcare in a research note on Tuesday. Finally, Truist Financial raised their target price on Molina Healthcare from $340.00 to $400.00 and gave the stock a "buy" rating in a report on Friday, April 11th. Nine research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $359.42.

View Our Latest Report on Molina Healthcare

Insider Buying and Selling

In related news, Director Steven J. Orlando sold 1,000 shares of Molina Healthcare stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $301.33, for a total value of $301,330.00. Following the sale, the director now directly owns 17,375 shares in the company, valued at $5,235,608.75. The trade was a 5.44 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 1.26% of the stock is currently owned by corporate insiders.

Molina Healthcare Stock Performance

NYSE MOH traded up $3.85 on Wednesday, reaching $339.35. The stock had a trading volume of 145,518 shares, compared to its average volume of 651,571. The business's 50-day moving average price is $312.03 and its 200 day moving average price is $308.21. Molina Healthcare, Inc. has a 12-month low of $262.32 and a 12-month high of $373.22. The stock has a market cap of $18.56 billion, a P/E ratio of 16.61, a price-to-earnings-growth ratio of 1.06 and a beta of 0.70. The company has a debt-to-equity ratio of 0.69, a quick ratio of 1.62 and a current ratio of 1.62.

Molina Healthcare (NYSE:MOH - Get Free Report) last released its quarterly earnings results on Wednesday, February 5th. The company reported $5.05 EPS for the quarter, missing the consensus estimate of $5.74 by ($0.69). Molina Healthcare had a return on equity of 28.13% and a net margin of 2.90%. As a group, equities analysts expect that Molina Healthcare, Inc. will post 24.4 earnings per share for the current year.

Molina Healthcare Profile

(

Free Report)

Molina Healthcare, Inc provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. It operates in four segments: Medicaid, Medicare, Marketplace, and Other. The company served in across 19 states. The company was founded in 1980 and is headquartered in Long Beach, California.

Featured Articles

Before you consider Molina Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molina Healthcare wasn't on the list.

While Molina Healthcare currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.