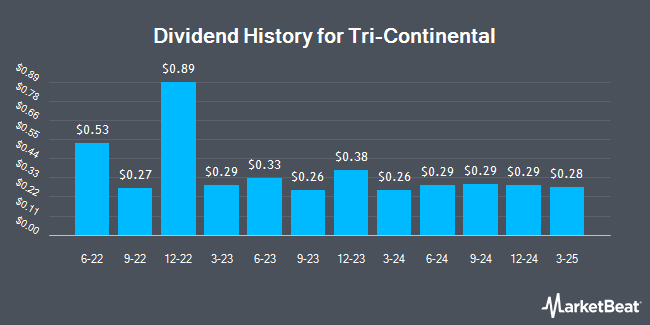

Tri-Continental Co. (NYSE:TY - Get Free Report) declared a quarterly dividend on Friday, March 7th, Wall Street Journal reports. Shareholders of record on Tuesday, March 18th will be given a dividend of 0.2766 per share by the investment management company on Wednesday, March 26th. This represents a $1.11 dividend on an annualized basis and a yield of 3.59%. The ex-dividend date of this dividend is Tuesday, March 18th.

Tri-Continental Stock Performance

Shares of NYSE TY traded up $0.44 during mid-day trading on Friday, reaching $30.84. 13,515 shares of the company were exchanged, compared to its average volume of 41,310. Tri-Continental has a twelve month low of $29.17 and a twelve month high of $34.82. The company's 50-day simple moving average is $32.14 and its 200-day simple moving average is $32.66.

Insiders Place Their Bets

In other news, Director Pamela G. Carlton sold 1,815 shares of the business's stock in a transaction dated Friday, March 7th. The shares were sold at an average price of $31.23, for a total value of $56,682.45. Following the completion of the sale, the director now owns 101 shares of the company's stock, valued at approximately $3,154.23. The trade was a 94.73 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Company insiders own 8.66% of the company's stock.

Tri-Continental Company Profile

(

Get Free Report)

Tri-Continental Corporation is a closed ended equity mutual fund launched and managed by Columbia Management Investment Advisers, LLC. It primarily invests in the public equity markets of the United States. The fund invests in stocks of companies that operate across diversified sectors. It seeks to invest in stocks of large-cap companies.

Read More

Before you consider Tri-Continental, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tri-Continental wasn't on the list.

While Tri-Continental currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.