Cerity Partners LLC raised its holdings in shares of Tri Pointe Homes, Inc. (NYSE:TPH - Free Report) by 113.9% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 63,847 shares of the construction company's stock after acquiring an additional 33,992 shares during the quarter. Cerity Partners LLC owned approximately 0.07% of Tri Pointe Homes worth $2,893,000 at the end of the most recent reporting period.

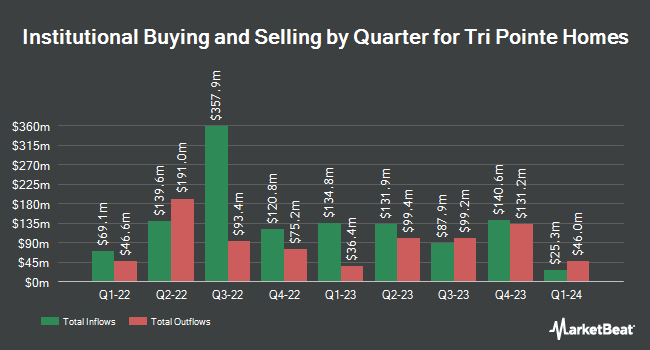

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Gradient Investments LLC acquired a new stake in Tri Pointe Homes in the 2nd quarter valued at $30,000. Reston Wealth Management LLC acquired a new stake in shares of Tri Pointe Homes in the third quarter valued at about $45,000. GAMMA Investing LLC raised its holdings in Tri Pointe Homes by 63.1% during the second quarter. GAMMA Investing LLC now owns 1,520 shares of the construction company's stock worth $57,000 after acquiring an additional 588 shares in the last quarter. Blue Trust Inc. boosted its position in Tri Pointe Homes by 31.7% during the second quarter. Blue Trust Inc. now owns 1,774 shares of the construction company's stock valued at $69,000 after purchasing an additional 427 shares during the last quarter. Finally, CWM LLC grew its stake in Tri Pointe Homes by 70.8% in the second quarter. CWM LLC now owns 2,220 shares of the construction company's stock valued at $83,000 after purchasing an additional 920 shares in the last quarter. 97.01% of the stock is currently owned by institutional investors and hedge funds.

Tri Pointe Homes Stock Performance

Tri Pointe Homes stock traded down $0.09 during mid-day trading on Friday, hitting $43.53. 332,088 shares of the company's stock traded hands, compared to its average volume of 642,174. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.64 and a quick ratio of 1.64. The firm has a 50 day simple moving average of $43.14 and a two-hundred day simple moving average of $41.70. Tri Pointe Homes, Inc. has a fifty-two week low of $28.74 and a fifty-two week high of $47.78. The stock has a market cap of $4.07 billion, a price-to-earnings ratio of 9.03, a P/E/G ratio of 0.71 and a beta of 1.60.

Tri Pointe Homes (NYSE:TPH - Get Free Report) last posted its earnings results on Thursday, October 24th. The construction company reported $1.18 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.07 by $0.11. Tri Pointe Homes had a net margin of 10.41% and a return on equity of 14.83%. The company had revenue of $1.11 billion during the quarter, compared to analysts' expectations of $1.05 billion. During the same quarter last year, the company posted $0.76 EPS. Tri Pointe Homes's quarterly revenue was up 34.9% compared to the same quarter last year. On average, research analysts expect that Tri Pointe Homes, Inc. will post 4.72 EPS for the current fiscal year.

Insider Transactions at Tri Pointe Homes

In other Tri Pointe Homes news, General Counsel David Ch Lee sold 5,000 shares of the stock in a transaction on Friday, September 13th. The stock was sold at an average price of $44.28, for a total transaction of $221,400.00. Following the transaction, the general counsel now owns 85,792 shares in the company, valued at $3,798,869.76. This trade represents a 5.51 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 2.00% of the company's stock.

Analyst Upgrades and Downgrades

TPH has been the topic of a number of analyst reports. Zelman & Associates upgraded Tri Pointe Homes from an "underperform" rating to a "neutral" rating and set a $43.00 price objective on the stock in a research note on Tuesday, September 17th. Oppenheimer dropped their price target on shares of Tri Pointe Homes from $56.00 to $53.00 and set an "outperform" rating on the stock in a research report on Friday, October 25th. Wedbush reissued a "neutral" rating and issued a $42.00 price objective on shares of Tri Pointe Homes in a research report on Thursday, October 24th. Finally, Royal Bank of Canada lowered their price objective on shares of Tri Pointe Homes from $48.00 to $45.00 and set an "outperform" rating on the stock in a research note on Friday, October 25th. Two investment analysts have rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $45.75.

View Our Latest Stock Analysis on Tri Pointe Homes

About Tri Pointe Homes

(

Free Report)

Tri Pointe Homes, Inc engages in the design, construction, and sale of single-family attached and detached homes in the United States. The company operates through a portfolio of six regional home building brands comprising Maracay in Arizona; Pardee Homes in California and Nevada; Quadrant Homes in Washington; Trendmaker Homes in Texas; TRI Pointe Homes in California, Colorado, and the Carolinas; and Winchester Homes in Maryland and Northern Virginia.

Featured Articles

Before you consider Tri Pointe Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tri Pointe Homes wasn't on the list.

While Tri Pointe Homes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2024, now is the time to give these stocks a look and pump up your 2025 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.