FMR LLC lessened its stake in Tri Pointe Homes, Inc. (NYSE:TPH - Free Report) by 2.6% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 546,961 shares of the construction company's stock after selling 14,482 shares during the quarter. FMR LLC owned about 0.58% of Tri Pointe Homes worth $24,783,000 at the end of the most recent quarter.

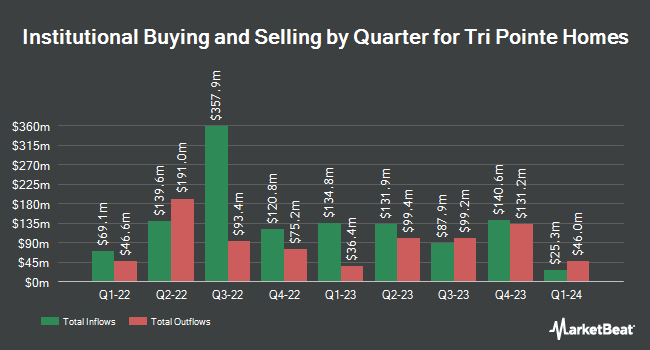

A number of other hedge funds have also made changes to their positions in TPH. Assenagon Asset Management S.A. raised its stake in shares of Tri Pointe Homes by 260.8% in the 3rd quarter. Assenagon Asset Management S.A. now owns 1,417,263 shares of the construction company's stock valued at $64,216,000 after acquiring an additional 1,024,425 shares during the period. Renaissance Technologies LLC raised its stake in shares of Tri Pointe Homes by 1,417.8% in the 2nd quarter. Renaissance Technologies LLC now owns 443,736 shares of the construction company's stock valued at $16,529,000 after acquiring an additional 414,500 shares during the period. Cubist Systematic Strategies LLC raised its stake in shares of Tri Pointe Homes by 149.5% in the 2nd quarter. Cubist Systematic Strategies LLC now owns 534,406 shares of the construction company's stock valued at $19,907,000 after acquiring an additional 320,221 shares during the period. Healthcare of Ontario Pension Plan Trust Fund purchased a new position in shares of Tri Pointe Homes in the 2nd quarter valued at $9,599,000. Finally, Connor Clark & Lunn Investment Management Ltd. raised its stake in shares of Tri Pointe Homes by 703.3% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 158,853 shares of the construction company's stock valued at $7,198,000 after acquiring an additional 139,079 shares during the period. Hedge funds and other institutional investors own 97.01% of the company's stock.

Insider Transactions at Tri Pointe Homes

In other news, General Counsel David Ch Lee sold 5,000 shares of Tri Pointe Homes stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $44.28, for a total value of $221,400.00. Following the completion of the transaction, the general counsel now directly owns 85,792 shares of the company's stock, valued at approximately $3,798,869.76. The trade was a 5.51 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Insiders own 2.50% of the company's stock.

Tri Pointe Homes Stock Down 1.9 %

Tri Pointe Homes stock traded down $0.80 during midday trading on Tuesday, hitting $41.18. 682,113 shares of the stock were exchanged, compared to its average volume of 879,257. The company has a 50 day moving average price of $42.85 and a two-hundred day moving average price of $41.83. The firm has a market cap of $3.85 billion, a P/E ratio of 8.55, a P/E/G ratio of 0.68 and a beta of 1.60. Tri Pointe Homes, Inc. has a 1 year low of $30.27 and a 1 year high of $47.78. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.64 and a quick ratio of 1.64.

Tri Pointe Homes (NYSE:TPH - Get Free Report) last released its earnings results on Thursday, October 24th. The construction company reported $1.18 earnings per share for the quarter, topping the consensus estimate of $1.07 by $0.11. The company had revenue of $1.11 billion during the quarter, compared to the consensus estimate of $1.05 billion. Tri Pointe Homes had a net margin of 10.41% and a return on equity of 14.83%. The company's revenue was up 34.9% on a year-over-year basis. During the same quarter in the previous year, the firm earned $0.76 EPS. On average, sell-side analysts predict that Tri Pointe Homes, Inc. will post 4.72 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

TPH has been the topic of a number of research reports. Zelman & Associates raised shares of Tri Pointe Homes from an "underperform" rating to a "neutral" rating and set a $43.00 target price on the stock in a research note on Tuesday, September 17th. Wedbush reissued a "neutral" rating and issued a $42.00 target price on shares of Tri Pointe Homes in a research note on Thursday, October 24th. Royal Bank of Canada dropped their price target on shares of Tri Pointe Homes from $48.00 to $45.00 and set an "outperform" rating on the stock in a research note on Friday, October 25th. Finally, Oppenheimer dropped their price target on shares of Tri Pointe Homes from $56.00 to $53.00 and set an "outperform" rating on the stock in a research note on Friday, October 25th. Two analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $45.75.

View Our Latest Research Report on Tri Pointe Homes

Tri Pointe Homes Profile

(

Free Report)

Tri Pointe Homes, Inc engages in the design, construction, and sale of single-family attached and detached homes in the United States. The company operates through a portfolio of six regional home building brands comprising Maracay in Arizona; Pardee Homes in California and Nevada; Quadrant Homes in Washington; Trendmaker Homes in Texas; TRI Pointe Homes in California, Colorado, and the Carolinas; and Winchester Homes in Maryland and Northern Virginia.

Featured Stories

Before you consider Tri Pointe Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tri Pointe Homes wasn't on the list.

While Tri Pointe Homes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.