Triasima Portfolio Management inc. trimmed its stake in shares of The Toronto-Dominion Bank (NYSE:TD - Free Report) TSE: TD by 95.9% in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 5,400 shares of the bank's stock after selling 127,122 shares during the period. Triasima Portfolio Management inc.'s holdings in Toronto-Dominion Bank were worth $287,000 as of its most recent filing with the Securities & Exchange Commission.

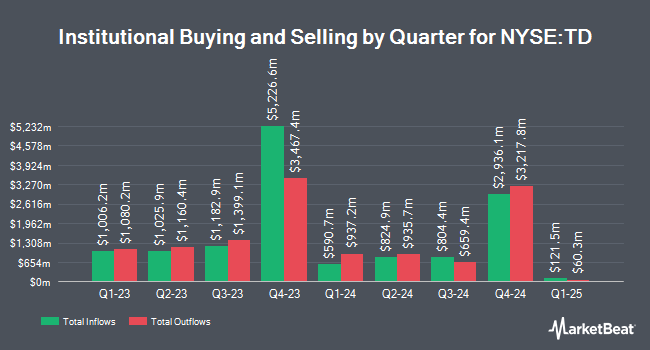

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in TD. Dunhill Financial LLC increased its position in shares of Toronto-Dominion Bank by 164.9% during the 3rd quarter. Dunhill Financial LLC now owns 400 shares of the bank's stock valued at $25,000 after purchasing an additional 249 shares during the last quarter. Versant Capital Management Inc increased its holdings in Toronto-Dominion Bank by 40.0% during the fourth quarter. Versant Capital Management Inc now owns 700 shares of the bank's stock valued at $37,000 after buying an additional 200 shares during the last quarter. Union Bancaire Privee UBP SA purchased a new position in shares of Toronto-Dominion Bank during the 4th quarter worth $58,000. Morse Asset Management Inc purchased a new position in shares of Toronto-Dominion Bank during the 3rd quarter worth $63,000. Finally, Eastern Bank bought a new stake in shares of Toronto-Dominion Bank during the 3rd quarter valued at $66,000. Institutional investors own 52.37% of the company's stock.

Wall Street Analyst Weigh In

TD has been the topic of several analyst reports. StockNews.com upgraded Toronto-Dominion Bank from a "sell" rating to a "hold" rating in a research report on Wednesday, February 5th. Bank of America raised Toronto-Dominion Bank from a "neutral" rating to a "buy" rating in a research report on Friday, January 17th. Scotiabank lowered shares of Toronto-Dominion Bank from a "sector outperform" rating to a "sector perform" rating in a report on Friday, December 6th. Jefferies Financial Group upgraded shares of Toronto-Dominion Bank from a "hold" rating to a "buy" rating in a research report on Thursday, December 12th. Finally, Barclays downgraded shares of Toronto-Dominion Bank from an "equal weight" rating to an "underweight" rating in a research report on Thursday, November 21st. One research analyst has rated the stock with a sell rating, six have given a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $80.50.

View Our Latest Stock Report on Toronto-Dominion Bank

Toronto-Dominion Bank Price Performance

TD traded up $0.66 during trading on Tuesday, reaching $60.70. 1,643,906 shares of the company traded hands, compared to its average volume of 2,888,900. The Toronto-Dominion Bank has a 12-month low of $51.25 and a 12-month high of $64.91. The company has a debt-to-equity ratio of 0.11, a quick ratio of 1.03 and a current ratio of 1.03. The firm has a fifty day simple moving average of $54.90 and a 200 day simple moving average of $57.39. The company has a market cap of $106.24 billion, a P/E ratio of 17.49, a PEG ratio of 1.86 and a beta of 0.84.

Toronto-Dominion Bank Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, January 31st. Shareholders of record on Friday, January 10th were issued a dividend of $0.7482 per share. This represents a $2.99 annualized dividend and a yield of 4.93%. The ex-dividend date of this dividend was Friday, January 10th. This is a boost from Toronto-Dominion Bank's previous quarterly dividend of $0.74. Toronto-Dominion Bank's dividend payout ratio (DPR) is currently 84.15%.

Toronto-Dominion Bank Company Profile

(

Free Report)

The Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Read More

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.