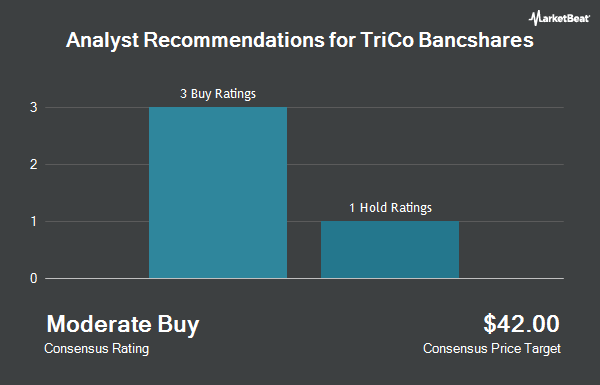

Shares of TriCo Bancshares (NASDAQ:TCBK - Get Free Report) have been given a consensus recommendation of "Hold" by the five brokerages that are covering the company, Marketbeat Ratings reports. Three analysts have rated the stock with a hold rating and two have issued a buy rating on the company. The average 1-year target price among brokers that have updated their coverage on the stock in the last year is $50.75.

Separately, Keefe, Bruyette & Woods decreased their target price on shares of TriCo Bancshares from $53.00 to $50.00 and set a "market perform" rating on the stock in a research report on Tuesday, January 28th.

Get Our Latest Stock Analysis on TriCo Bancshares

TriCo Bancshares Price Performance

NASDAQ TCBK traded down $0.84 during trading on Wednesday, hitting $36.29. 168,340 shares of the stock traded hands, compared to its average volume of 115,048. The company has a quick ratio of 0.86, a current ratio of 0.86 and a debt-to-equity ratio of 0.30. TriCo Bancshares has a 12-month low of $31.73 and a 12-month high of $51.06. The firm has a 50-day simple moving average of $42.40 and a 200-day simple moving average of $43.94. The company has a market capitalization of $1.20 billion, a P/E ratio of 10.49 and a beta of 0.55.

TriCo Bancshares (NASDAQ:TCBK - Get Free Report) last posted its earnings results on Thursday, January 23rd. The financial services provider reported $0.88 earnings per share for the quarter, beating analysts' consensus estimates of $0.79 by $0.09. TriCo Bancshares had a net margin of 21.63% and a return on equity of 9.63%. As a group, analysts predict that TriCo Bancshares will post 3.35 EPS for the current year.

TriCo Bancshares Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, March 21st. Investors of record on Friday, March 7th were paid a dividend of $0.33 per share. The ex-dividend date of this dividend was Friday, March 7th. This represents a $1.32 dividend on an annualized basis and a dividend yield of 3.64%. TriCo Bancshares's dividend payout ratio is presently 38.15%.

Institutional Trading of TriCo Bancshares

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. FMR LLC raised its holdings in shares of TriCo Bancshares by 18.1% in the fourth quarter. FMR LLC now owns 2,889,943 shares of the financial services provider's stock worth $126,291,000 after buying an additional 443,858 shares during the period. Bolthouse Investments LLC bought a new position in TriCo Bancshares in the 4th quarter valued at $15,457,000. Proficio Capital Partners LLC purchased a new stake in TriCo Bancshares in the fourth quarter worth $1,818,000. Dimensional Fund Advisors LP lifted its position in shares of TriCo Bancshares by 2.5% during the fourth quarter. Dimensional Fund Advisors LP now owns 1,634,684 shares of the financial services provider's stock worth $71,436,000 after purchasing an additional 39,684 shares during the last quarter. Finally, Franklin Resources Inc. boosted its stake in shares of TriCo Bancshares by 2.4% during the fourth quarter. Franklin Resources Inc. now owns 1,568,560 shares of the financial services provider's stock valued at $68,546,000 after purchasing an additional 37,191 shares during the period. 59.11% of the stock is owned by hedge funds and other institutional investors.

About TriCo Bancshares

(

Get Free ReportTriCo Bancshares operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers. The company accepts demand, savings, and time deposits. It also provides small business loans; real estate mortgage loans, such as residential and commercial loans; consumer loans; mortgage, auto, other vehicle, and personal loans; commercial loans, including agricultural loans; and real estate construction loans.

Read More

Before you consider TriCo Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TriCo Bancshares wasn't on the list.

While TriCo Bancshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.