Trillium Asset Management LLC lessened its holdings in shares of Starbucks Co. (NASDAQ:SBUX - Free Report) by 6.1% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 235,441 shares of the coffee company's stock after selling 15,289 shares during the quarter. Trillium Asset Management LLC's holdings in Starbucks were worth $21,484,000 at the end of the most recent quarter.

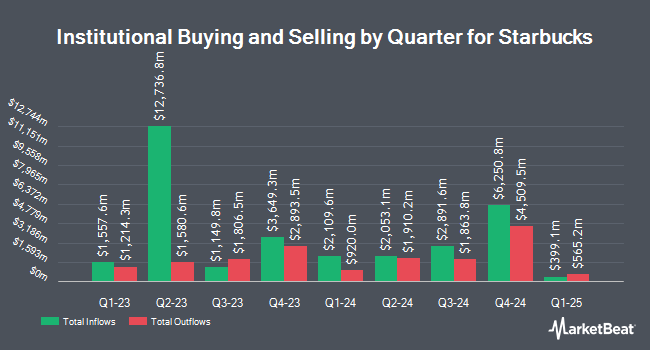

Other hedge funds have also recently bought and sold shares of the company. Wellington Management Group LLP grew its position in shares of Starbucks by 100.6% in the 3rd quarter. Wellington Management Group LLP now owns 15,149,937 shares of the coffee company's stock worth $1,476,967,000 after acquiring an additional 7,598,146 shares in the last quarter. FMR LLC grew its position in shares of Starbucks by 55.0% in the 3rd quarter. FMR LLC now owns 19,779,859 shares of the coffee company's stock worth $1,928,339,000 after acquiring an additional 7,015,375 shares in the last quarter. Raymond James Financial Inc. acquired a new position in shares of Starbucks in the 4th quarter worth approximately $284,283,000. Assenagon Asset Management S.A. grew its position in shares of Starbucks by 1,491.4% in the 4th quarter. Assenagon Asset Management S.A. now owns 2,808,571 shares of the coffee company's stock worth $256,282,000 after acquiring an additional 2,632,087 shares in the last quarter. Finally, Healthcare of Ontario Pension Plan Trust Fund grew its position in shares of Starbucks by 1,078.5% in the 3rd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 2,545,419 shares of the coffee company's stock worth $248,153,000 after acquiring an additional 2,329,431 shares in the last quarter. Institutional investors and hedge funds own 72.29% of the company's stock.

Starbucks Trading Down 2.2 %

Shares of NASDAQ SBUX traded down $2.21 during mid-day trading on Friday, reaching $97.07. The company had a trading volume of 11,365,165 shares, compared to its average volume of 10,616,667. The stock has a market cap of $110.26 billion, a PE ratio of 31.31, a P/E/G ratio of 3.59 and a beta of 0.99. The company has a 50-day moving average price of $105.41 and a two-hundred day moving average price of $99.36. Starbucks Co. has a 1-year low of $71.55 and a 1-year high of $117.46.

Starbucks (NASDAQ:SBUX - Get Free Report) last issued its earnings results on Tuesday, January 28th. The coffee company reported $0.69 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.68 by $0.01. Starbucks had a negative return on equity of 44.97% and a net margin of 9.73%. During the same period in the previous year, the business posted $0.90 EPS. On average, research analysts expect that Starbucks Co. will post 2.99 EPS for the current year.

Analysts Set New Price Targets

Several brokerages have recently commented on SBUX. Royal Bank of Canada reiterated an "outperform" rating and issued a $115.00 target price on shares of Starbucks in a research report on Friday, January 24th. Stifel Nicolaus raised their price target on Starbucks from $110.00 to $114.00 and gave the stock a "buy" rating in a report on Monday, January 27th. Wells Fargo & Company raised their price target on Starbucks from $115.00 to $125.00 and gave the stock an "overweight" rating in a report on Tuesday, February 25th. BMO Capital Markets raised their price target on Starbucks from $110.00 to $115.00 and gave the stock an "outperform" rating in a report on Wednesday, January 29th. Finally, Argus raised Starbucks from a "hold" rating to a "buy" rating and set a $115.00 price target on the stock in a report on Tuesday, March 18th. Three investment analysts have rated the stock with a sell rating, six have assigned a hold rating, eighteen have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, Starbucks currently has an average rating of "Moderate Buy" and a consensus price target of $106.12.

Check Out Our Latest Stock Analysis on SBUX

Starbucks Company Profile

(

Free Report)

Starbucks Corporation, together with its subsidiaries, operates as a roaster, marketer, and retailer of coffee worldwide. The company operates through three segments: North America, International, and Channel Development. Its stores offer coffee and tea beverages, roasted whole beans and ground coffees, single serve products, and ready-to-drink beverages; and various food products, such as pastries, breakfast sandwiches, and lunch items.

See Also

Before you consider Starbucks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Starbucks wasn't on the list.

While Starbucks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.