Trisura Group (TSE:TSU - Free Report) had its price target decreased by Scotiabank from C$52.00 to C$49.00 in a research note published on Thursday morning,BayStreet.CA reports. Scotiabank currently has a sector perform rating on the stock.

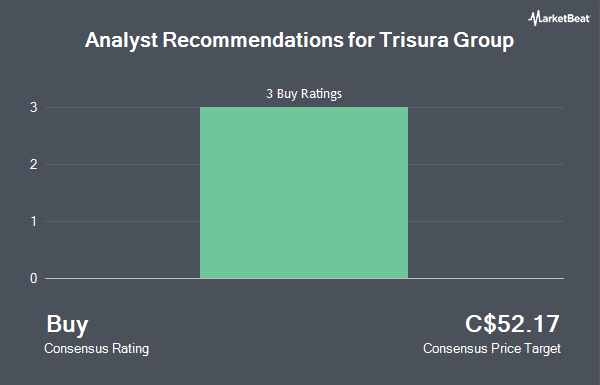

A number of other research firms also recently weighed in on TSU. CIBC dropped their price target on Trisura Group from C$60.00 to C$50.00 and set an "outperform" rating on the stock in a research note on Thursday, January 30th. Raymond James reduced their price target on shares of Trisura Group from C$64.00 to C$57.00 in a research report on Tuesday, February 18th. Finally, Cormark decreased their target price on shares of Trisura Group from C$54.00 to C$47.00 in a research report on Monday, February 10th. One research analyst has rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of C$53.44.

View Our Latest Analysis on TSU

Trisura Group Trading Down 0.2 %

TSE TSU traded down C$0.08 on Thursday, hitting C$33.43. 85,414 shares of the company were exchanged, compared to its average volume of 105,922. The stock has a fifty day moving average of C$33.73 and a 200-day moving average of C$38.21. Trisura Group has a 12 month low of C$31.19 and a 12 month high of C$46.75. The company has a market cap of C$1.60 billion, a PE ratio of 14.37 and a beta of 0.82.

Trisura Group Company Profile

(

Get Free Report)

Trisura Group Ltd is a Canadian based company engages in the provision of specialty insurance. The company's operations currently include specialty property and casualty insurance (Surety, Risk Solutions, and Corporate Insurance business lines), underwritten predominantly in Canada. The operating business segments are Trisura Guarantee, Trisura Specialty, and Trisura International.

Further Reading

Before you consider Trisura Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trisura Group wasn't on the list.

While Trisura Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.