Tritonpoint Wealth LLC lessened its stake in shares of Schlumberger Limited (NYSE:SLB - Free Report) by 40.6% during the fourth quarter, according to the company in its most recent disclosure with the SEC. The fund owned 21,402 shares of the oil and gas company's stock after selling 14,601 shares during the quarter. Tritonpoint Wealth LLC's holdings in Schlumberger were worth $828,000 as of its most recent SEC filing.

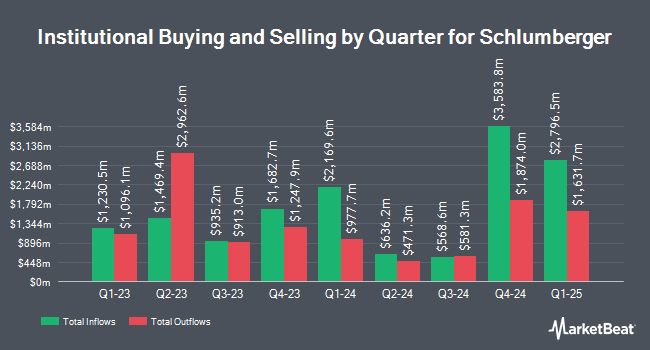

Several other institutional investors also recently modified their holdings of SLB. ORG Partners LLC boosted its holdings in shares of Schlumberger by 393.5% during the 3rd quarter. ORG Partners LLC now owns 607 shares of the oil and gas company's stock valued at $25,000 after acquiring an additional 484 shares in the last quarter. Prospera Private Wealth LLC bought a new position in Schlumberger in the third quarter valued at about $29,000. Ashton Thomas Securities LLC acquired a new stake in shares of Schlumberger during the third quarter valued at about $37,000. DiNuzzo Private Wealth Inc. grew its holdings in shares of Schlumberger by 1,068.3% during the third quarter. DiNuzzo Private Wealth Inc. now owns 958 shares of the oil and gas company's stock worth $40,000 after purchasing an additional 876 shares during the last quarter. Finally, J. Stern & Co. LLP acquired a new position in shares of Schlumberger in the third quarter valued at approximately $47,000. 81.99% of the stock is currently owned by institutional investors and hedge funds.

Schlumberger Stock Performance

Shares of Schlumberger stock opened at $40.21 on Monday. The business has a 50-day simple moving average of $40.49 and a 200 day simple moving average of $42.54. The firm has a market capitalization of $56.32 billion, a price-to-earnings ratio of 12.93, a PEG ratio of 9.70 and a beta of 1.52. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.45 and a quick ratio of 1.11. Schlumberger Limited has a one year low of $36.52 and a one year high of $55.69.

Schlumberger (NYSE:SLB - Get Free Report) last posted its quarterly earnings results on Friday, January 17th. The oil and gas company reported $0.92 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.90 by $0.02. The business had revenue of $9.28 billion during the quarter, compared to the consensus estimate of $9.24 billion. Schlumberger had a net margin of 12.29% and a return on equity of 21.90%. Schlumberger's revenue was up 3.3% compared to the same quarter last year. During the same quarter last year, the firm posted $0.86 EPS. On average, research analysts anticipate that Schlumberger Limited will post 3.38 earnings per share for the current fiscal year.

Schlumberger Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, April 3rd. Stockholders of record on Wednesday, February 5th will be issued a $0.285 dividend. This represents a $1.14 dividend on an annualized basis and a dividend yield of 2.84%. The ex-dividend date is Wednesday, February 5th. This is a positive change from Schlumberger's previous quarterly dividend of $0.28. Schlumberger's dividend payout ratio (DPR) is currently 36.66%.

Analysts Set New Price Targets

SLB has been the topic of several recent research reports. Susquehanna cut their target price on shares of Schlumberger from $60.00 to $56.00 and set a "positive" rating on the stock in a research report on Monday, October 21st. Sanford C. Bernstein raised shares of Schlumberger to a "strong-buy" rating in a research note on Tuesday, November 12th. Citigroup raised their target price on Schlumberger from $50.00 to $54.00 and gave the stock a "buy" rating in a research report on Tuesday, January 21st. Piper Sandler assumed coverage on Schlumberger in a research report on Thursday, December 19th. They issued a "neutral" rating and a $47.00 price target on the stock. Finally, Barclays lowered their price objective on Schlumberger from $61.00 to $53.00 and set an "overweight" rating for the company in a research report on Wednesday, December 18th. Six equities research analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $55.81.

Read Our Latest Research Report on Schlumberger

Insider Buying and Selling

In other news, Director Vijay Kasibhatla sold 25,000 shares of the company's stock in a transaction that occurred on Tuesday, January 21st. The stock was sold at an average price of $43.94, for a total value of $1,098,500.00. Following the completion of the transaction, the director now directly owns 49,595 shares of the company's stock, valued at $2,179,204.30. This represents a 33.51 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, EVP Abdellah Merad sold 60,000 shares of the firm's stock in a transaction on Wednesday, January 29th. The shares were sold at an average price of $41.44, for a total value of $2,486,400.00. Following the sale, the executive vice president now directly owns 210,502 shares of the company's stock, valued at approximately $8,723,202.88. This represents a 22.18 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 263,782 shares of company stock worth $11,442,229. 0.26% of the stock is owned by corporate insiders.

Schlumberger Profile

(

Free Report)

Schlumberger Limited engages in the provision of technology for the energy industry worldwide. The company operates through four divisions: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems. The company provides field development and hydrocarbon production, carbon management, and integration of adjacent energy systems; reservoir interpretation and data processing services for exploration data; and well construction and production improvement services and products.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Schlumberger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schlumberger wasn't on the list.

While Schlumberger currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.