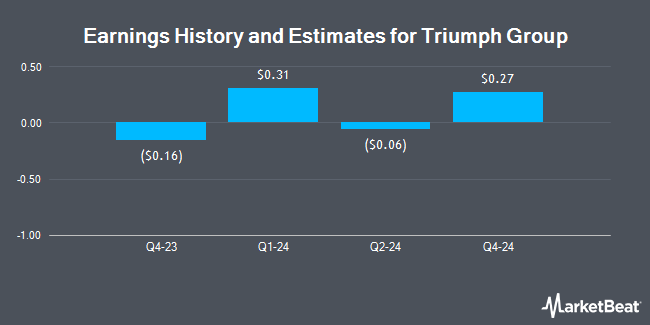

Triumph Group (NYSE:TGI - Get Free Report) updated its FY25 earnings guidance on Tuesday. The company provided EPS guidance of $0.70-0.76 for the period, compared to the consensus EPS estimate of $0.42. The company issued revenue guidance of $1.2 billion, compared to the consensus revenue estimate of $1.20 billion. Triumph Group also updated its FY 2025 guidance to 0.700-0.760 EPS.

Analysts Set New Price Targets

TGI has been the subject of a number of research analyst reports. Jefferies Financial Group reaffirmed a "hold" rating and set a $14.00 price objective (down from $20.00) on shares of Triumph Group in a report on Monday, August 12th. Barclays decreased their price objective on Triumph Group from $18.00 to $16.00 and set an "overweight" rating for the company in a report on Monday, August 12th. Bank of America downgraded Triumph Group from a "buy" rating to an "underperform" rating and cut their price target for the company from $17.00 to $12.00 in a report on Tuesday, September 24th. The Goldman Sachs Group cut shares of Triumph Group from a "buy" rating to a "neutral" rating and dropped their target price for the stock from $19.00 to $15.00 in a report on Tuesday, August 13th. Finally, JPMorgan Chase & Co. lowered shares of Triumph Group from a "neutral" rating to an "underweight" rating and decreased their price objective for the stock from $15.00 to $12.00 in a research note on Monday, October 14th. Two analysts have rated the stock with a sell rating, five have given a hold rating and three have issued a buy rating to the stock. According to MarketBeat, Triumph Group currently has a consensus rating of "Hold" and a consensus target price of $14.78.

Read Our Latest Research Report on Triumph Group

Triumph Group Stock Up 13.7 %

Triumph Group stock traded up $2.23 during midday trading on Tuesday, reaching $18.50. The company's stock had a trading volume of 1,561,035 shares, compared to its average volume of 874,730. The company has a market cap of $1.43 billion, a P/E ratio of 2.95 and a beta of 2.48. The business has a 50-day simple moving average of $13.82 and a 200-day simple moving average of $14.44. Triumph Group has a fifty-two week low of $10.08 and a fifty-two week high of $19.71.

Triumph Group Company Profile

(

Get Free Report)

Triumph Group, Inc designs, engineers, manufactures, repairs, overhauls, and distributes aircraft, aircraft components, accessories, subassemblies, and systems worldwide. It operates in two segments, Triumph Systems & Support, and Triumph Interiors. The company offers aircraft and engine-mounted accessory drives, thermal control systems and components, cargo hooks, high lift actuations, cockpit control levers, hydraulic systems and components, control system valve bodies, landing gear actuation systems, electronic engine controls, landing gear components and assemblies, cyber protected process controllers, main engine gearbox assemblies, geared transmissions and drive train components, main fuel pumps, fuel-metering units, primary and secondary flight control systems, and vibration absorbers.

Read More

Before you consider Triumph Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Triumph Group wasn't on the list.

While Triumph Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.