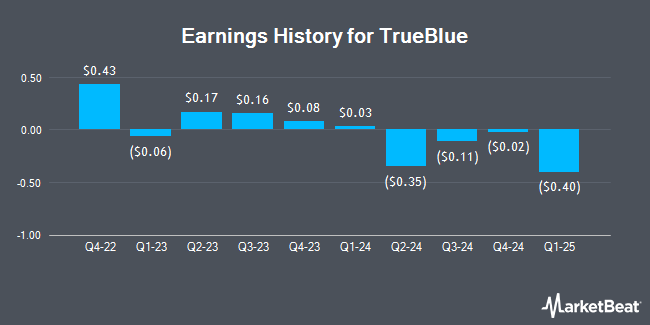

TrueBlue (NYSE:TBI - Get Free Report) announced its quarterly earnings results on Monday. The business services provider reported ($0.11) EPS for the quarter, topping analysts' consensus estimates of ($0.15) by $0.04, Briefing.com reports. TrueBlue had a negative return on equity of 0.55% and a negative net margin of 6.18%. The company had revenue of $382.36 million during the quarter, compared to analyst estimates of $386.07 million. During the same quarter last year, the firm posted $0.16 earnings per share. The firm's revenue was down 19.2% on a year-over-year basis. TrueBlue updated its Q4 2024 guidance to EPS.

TrueBlue Stock Down 4.2 %

Shares of NYSE:TBI traded down $0.33 on Tuesday, hitting $7.34. 256,430 shares of the company traded hands, compared to its average volume of 319,470. TrueBlue has a 52 week low of $6.97 and a 52 week high of $16.14. The stock has a 50 day simple moving average of $7.63 and a 200-day simple moving average of $9.32. The company has a market cap of $224.23 million, a PE ratio of -2.05 and a beta of 1.49.

Analyst Upgrades and Downgrades

A number of analysts recently commented on TBI shares. StockNews.com lowered TrueBlue from a "hold" rating to a "sell" rating in a research note on Tuesday, August 6th. BMO Capital Markets lowered their price objective on TrueBlue from $11.00 to $10.00 and set an "outperform" rating for the company in a research report on Tuesday.

Check Out Our Latest Report on TrueBlue

TrueBlue Company Profile

(

Get Free Report)

TrueBlue, Inc, together with its subsidiaries, provides specialized workforce solutions in the United States, Canada, the United Kingdom, Australia, and Puerto Rico. It operates through three segments: PeopleReady, PeopleManagement, and PeopleScout. The company PeopleReady segment provides general, industrial, and skilled trade contingent staffing services for construction, transportation, manufacturing, retail, hospitality, and renewable energy industries.

Featured Articles

Before you consider TrueBlue, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TrueBlue wasn't on the list.

While TrueBlue currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.