TrueMark Investments LLC reduced its position in shares of Uniti Group Inc. (NASDAQ:UNIT - Free Report) by 88.3% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 13,125 shares of the real estate investment trust's stock after selling 98,823 shares during the quarter. TrueMark Investments LLC's holdings in Uniti Group were worth $72,000 as of its most recent filing with the Securities and Exchange Commission.

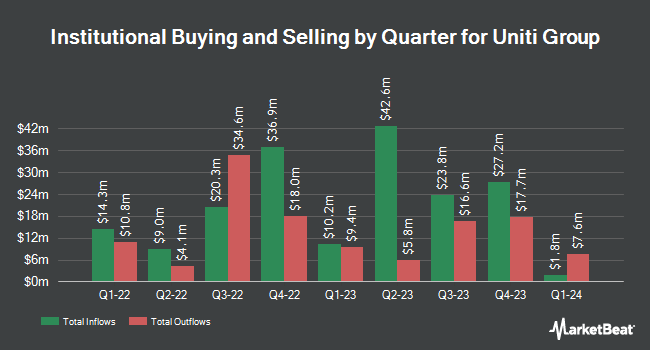

Other large investors also recently added to or reduced their stakes in the company. Signaturefd LLC lifted its stake in Uniti Group by 51.3% in the fourth quarter. Signaturefd LLC now owns 8,460 shares of the real estate investment trust's stock valued at $47,000 after buying an additional 2,870 shares during the period. Proficio Capital Partners LLC acquired a new position in Uniti Group during the fourth quarter valued at approximately $68,000. Pitcairn Co. bought a new stake in Uniti Group in the third quarter valued at approximately $69,000. Virtu Financial LLC acquired a new stake in Uniti Group in the third quarter worth $70,000. Finally, Handelsbanken Fonder AB bought a new position in shares of Uniti Group during the fourth quarter worth $71,000. 87.51% of the stock is currently owned by institutional investors and hedge funds.

Uniti Group Stock Performance

NASDAQ:UNIT opened at $5.04 on Tuesday. The stock has a 50-day simple moving average of $5.37 and a 200 day simple moving average of $5.54. Uniti Group Inc. has a 52-week low of $2.57 and a 52-week high of $6.31. The company has a market cap of $1.23 billion, a PE ratio of 12.29 and a beta of 1.70.

Uniti Group (NASDAQ:UNIT - Get Free Report) last released its earnings results on Friday, February 21st. The real estate investment trust reported $0.35 earnings per share for the quarter, beating analysts' consensus estimates of $0.33 by $0.02. Uniti Group had a net margin of 8.82% and a negative return on equity of 4.12%. The business had revenue of $293.32 million during the quarter, compared to the consensus estimate of $294.59 million. On average, research analysts predict that Uniti Group Inc. will post 1.28 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of research firms recently commented on UNIT. Raymond James upgraded shares of Uniti Group from an "outperform" rating to a "strong-buy" rating and upped their price objective for the company from $6.00 to $8.00 in a research report on Monday, February 24th. Royal Bank of Canada lifted their price objective on Uniti Group from $5.50 to $6.00 and gave the company a "sector perform" rating in a report on Monday, December 23rd.

Get Our Latest Stock Analysis on UNIT

Uniti Group Company Profile

(

Free Report)

Uniti Group, Inc is a real estate investment trust company, which engages in the acquisition, construction, and leasing of properties. It operates through the following business segments: Uniti Leasing, Uniti Fiber, and Corporate. The Uniti Leasing segment involves mission-critical communications assets on exclusive or shared-tenant basis, and dark fiber network.

See Also

Before you consider Uniti Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uniti Group wasn't on the list.

While Uniti Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.