Truffle Hound Capital LLC bought a new stake in Trinseo PLC (NYSE:TSE - Free Report) during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 350,000 shares of the basic materials company's stock, valued at approximately $1,785,000. Truffle Hound Capital LLC owned about 0.99% of Trinseo as of its most recent SEC filing.

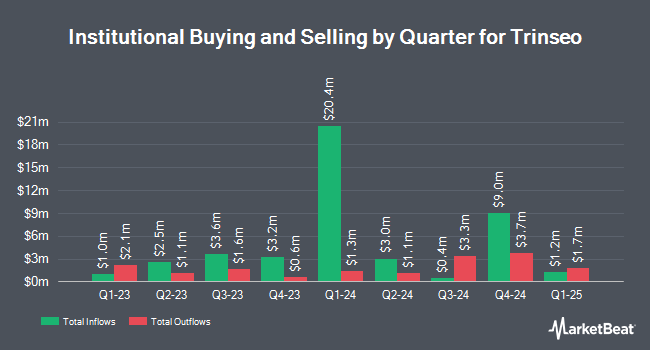

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the business. Rhumbline Advisers raised its stake in shares of Trinseo by 103.2% during the fourth quarter. Rhumbline Advisers now owns 7,879 shares of the basic materials company's stock valued at $40,000 after acquiring an additional 4,002 shares during the last quarter. SG Americas Securities LLC acquired a new stake in Trinseo in the fourth quarter valued at $51,000. XTX Topco Ltd raised its position in Trinseo by 19.1% during the 3rd quarter. XTX Topco Ltd now owns 88,262 shares of the basic materials company's stock worth $451,000 after purchasing an additional 14,180 shares during the last quarter. Geode Capital Management LLC lifted its holdings in Trinseo by 4.0% during the 3rd quarter. Geode Capital Management LLC now owns 385,931 shares of the basic materials company's stock worth $1,973,000 after buying an additional 14,780 shares during the period. Finally, FMR LLC grew its position in shares of Trinseo by 21.3% in the 3rd quarter. FMR LLC now owns 110,896 shares of the basic materials company's stock valued at $567,000 after buying an additional 19,477 shares during the last quarter. Institutional investors own 82.69% of the company's stock.

Trinseo Stock Performance

Shares of TSE stock traded up $0.13 on Wednesday, hitting $4.04. The company had a trading volume of 286,065 shares, compared to its average volume of 451,738. Trinseo PLC has a twelve month low of $1.94 and a twelve month high of $7.05. The firm has a market cap of $143.17 million, a P/E ratio of -0.41 and a beta of 1.44. The stock's 50-day moving average is $4.58 and its two-hundred day moving average is $4.73.

Trinseo (NYSE:TSE - Get Free Report) last posted its quarterly earnings data on Wednesday, February 12th. The basic materials company reported ($2.67) earnings per share for the quarter, missing the consensus estimate of ($2.30) by ($0.37). Equities research analysts predict that Trinseo PLC will post -3.88 EPS for the current year.

Trinseo Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, April 24th. Stockholders of record on Thursday, April 10th will be paid a $0.01 dividend. This represents a $0.04 dividend on an annualized basis and a dividend yield of 0.99%. The ex-dividend date of this dividend is Thursday, April 10th. Trinseo's dividend payout ratio is -0.41%.

About Trinseo

(

Free Report)

Trinseo PLC operates as a specialty material solutions provider in the United States, Europe, the Asia-Pacific, and internationally. It operates through five segments: Engineered Materials, Latex Binders, Plastics Solutions, Polystyrene, and Americas Styrenics. The Engineered Materials segment offers rigid thermoplastic compounds and blends, soft thermoplastic, continuous cast, cell cast, activated methyl methacrylates (MMA), PMMA resins, and extruded PMMA sheets and resins for consumer electronics, medical, footwear, automotive, and building and construction applications under the EMERGE, CALIBRE, PLEXIGLAS, ALTUGLAS, ACRYSPA, AVONITE, STUDIO, MEGOL, APILON, APIGO, and APINAT brands.

See Also

Before you consider Trinseo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trinseo wasn't on the list.

While Trinseo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.