SolarEdge Technologies (NASDAQ:SEDG - Free Report) had its target price lowered by Truist Financial from $20.00 to $15.00 in a research note published on Friday morning,Benzinga reports. The firm currently has a hold rating on the semiconductor company's stock.

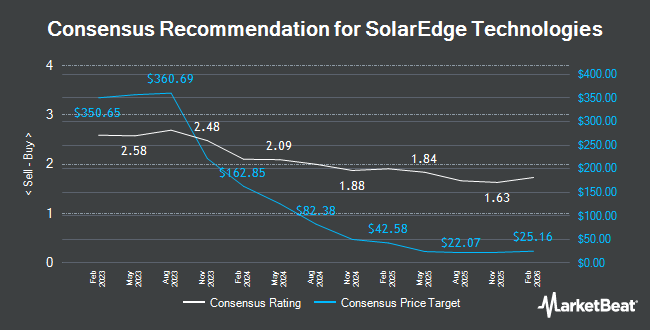

A number of other analysts have also weighed in on the stock. Roth Mkm cut their price objective on shares of SolarEdge Technologies from $20.00 to $12.00 and set a "neutral" rating on the stock in a research note on Thursday. JPMorgan Chase & Co. cut their price target on SolarEdge Technologies from $35.00 to $29.00 and set an "overweight" rating on the stock in a research report on Wednesday, October 23rd. Glj Research lowered SolarEdge Technologies from a "strong-buy" rating to a "strong sell" rating in a research note on Tuesday, October 8th. BMO Capital Markets lowered their target price on SolarEdge Technologies from $21.00 to $12.00 and set a "market perform" rating on the stock in a research note on Thursday. Finally, Morgan Stanley reduced their price target on SolarEdge Technologies from $28.00 to $23.00 and set an "equal weight" rating for the company in a research report on Tuesday, October 8th. Nine analysts have rated the stock with a sell rating, nineteen have assigned a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $23.79.

Read Our Latest Stock Analysis on SolarEdge Technologies

SolarEdge Technologies Stock Down 9.1 %

NASDAQ:SEDG traded down $1.35 during mid-day trading on Friday, hitting $13.53. 7,872,062 shares of the company's stock traded hands, compared to its average volume of 3,473,123. The company has a fifty day moving average of $19.34 and a 200 day moving average of $31.18. The company has a debt-to-equity ratio of 0.32, a quick ratio of 2.45 and a current ratio of 5.10. SolarEdge Technologies has a twelve month low of $12.38 and a twelve month high of $103.15. The company has a market capitalization of $775.27 million, a P/E ratio of -0.46 and a beta of 1.59.

SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) last released its earnings results on Wednesday, August 7th. The semiconductor company reported ($1.79) EPS for the quarter, missing analysts' consensus estimates of ($1.60) by ($0.19). The company had revenue of $265.41 million during the quarter, compared to analyst estimates of $264.31 million. SolarEdge Technologies had a negative return on equity of 56.32% and a negative net margin of 158.19%. During the same quarter last year, the business earned $2.06 earnings per share. The firm's revenue for the quarter was down 73.2% on a year-over-year basis. On average, analysts forecast that SolarEdge Technologies will post -8.85 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in SEDG. Advisors Asset Management Inc. boosted its stake in SolarEdge Technologies by 86.5% during the third quarter. Advisors Asset Management Inc. now owns 15,307 shares of the semiconductor company's stock worth $351,000 after buying an additional 7,099 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. boosted its position in shares of SolarEdge Technologies by 683.1% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 252,553 shares of the semiconductor company's stock valued at $5,786,000 after acquiring an additional 220,304 shares during the last quarter. AMG National Trust Bank purchased a new stake in shares of SolarEdge Technologies in the third quarter valued at about $4,055,000. Mizuho Markets Americas LLC grew its holdings in shares of SolarEdge Technologies by 653.4% in the third quarter. Mizuho Markets Americas LLC now owns 188,340 shares of the semiconductor company's stock valued at $4,315,000 after purchasing an additional 163,340 shares during the period. Finally, KBC Group NV increased its position in SolarEdge Technologies by 95.8% during the third quarter. KBC Group NV now owns 2,816 shares of the semiconductor company's stock worth $65,000 after purchasing an additional 1,378 shares during the last quarter. 95.10% of the stock is currently owned by institutional investors and hedge funds.

SolarEdge Technologies Company Profile

(

Get Free Report)

SolarEdge Technologies, Inc, together with its subsidiaries, designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally. It operates in two segments, Solar and Energy Storage.

Recommended Stories

Before you consider SolarEdge Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarEdge Technologies wasn't on the list.

While SolarEdge Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.