Tractor Supply (NASDAQ:TSCO - Get Free Report) had its price objective dropped by equities research analysts at Truist Financial from $63.00 to $60.00 in a research note issued to investors on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the specialty retailer's stock. Truist Financial's price target indicates a potential upside of 11.07% from the company's current price.

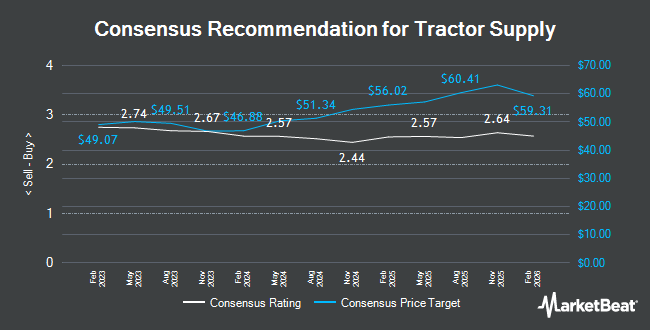

Several other analysts have also recently commented on TSCO. Citigroup cut shares of Tractor Supply from a "strong-buy" rating to a "hold" rating in a research report on Thursday, October 17th. Benchmark raised their target price on Tractor Supply from $56.00 to $62.00 and gave the stock a "buy" rating in a report on Monday, October 28th. Wells Fargo & Company lowered their price target on Tractor Supply from $65.00 to $64.00 and set an "overweight" rating for the company in a research note on Monday, November 25th. Gordon Haskett lowered shares of Tractor Supply from a "strong-buy" rating to a "moderate buy" rating in a research note on Thursday, October 24th. Finally, UBS Group upped their target price on shares of Tractor Supply from $54.40 to $56.00 and gave the company a "neutral" rating in a research note on Friday, October 25th. Two investment analysts have rated the stock with a sell rating, six have given a hold rating, thirteen have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $58.85.

View Our Latest Stock Report on Tractor Supply

Tractor Supply Price Performance

Shares of Tractor Supply stock traded down $0.27 during trading on Friday, reaching $54.02. The company's stock had a trading volume of 1,672,364 shares, compared to its average volume of 5,152,622. Tractor Supply has a one year low of $44.35 and a one year high of $61.53. The stock has a 50-day moving average price of $55.28 and a two-hundred day moving average price of $55.23. The stock has a market capitalization of $28.86 billion, a P/E ratio of 26.24, a price-to-earnings-growth ratio of 3.29 and a beta of 0.84. The company has a current ratio of 1.48, a quick ratio of 0.17 and a debt-to-equity ratio of 0.81.

Tractor Supply (NASDAQ:TSCO - Get Free Report) last issued its quarterly earnings results on Thursday, January 30th. The specialty retailer reported $0.44 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.28 by ($1.84). Tractor Supply had a net margin of 7.53% and a return on equity of 50.19%. As a group, sell-side analysts anticipate that Tractor Supply will post 2.05 EPS for the current fiscal year.

Institutional Trading of Tractor Supply

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Henrickson Nauta Wealth Advisors Inc. grew its position in Tractor Supply by 3.2% in the third quarter. Henrickson Nauta Wealth Advisors Inc. now owns 1,127 shares of the specialty retailer's stock valued at $328,000 after purchasing an additional 35 shares in the last quarter. Private Advisor Group LLC boosted its stake in shares of Tractor Supply by 0.5% during the 3rd quarter. Private Advisor Group LLC now owns 7,693 shares of the specialty retailer's stock worth $2,238,000 after buying an additional 37 shares during the last quarter. Baldwin Investment Management LLC grew its holdings in shares of Tractor Supply by 0.3% in the 3rd quarter. Baldwin Investment Management LLC now owns 11,402 shares of the specialty retailer's stock valued at $3,317,000 after acquiring an additional 38 shares in the last quarter. TCI Wealth Advisors Inc. increased its position in shares of Tractor Supply by 5.1% in the third quarter. TCI Wealth Advisors Inc. now owns 846 shares of the specialty retailer's stock valued at $246,000 after acquiring an additional 41 shares during the last quarter. Finally, Huntington National Bank increased its position in shares of Tractor Supply by 0.7% in the third quarter. Huntington National Bank now owns 5,538 shares of the specialty retailer's stock valued at $1,611,000 after acquiring an additional 41 shares during the last quarter. 98.72% of the stock is currently owned by institutional investors and hedge funds.

Tractor Supply Company Profile

(

Get Free Report)

Tractor Supply Company operates as a rural lifestyle retailer in the United States. The company offers various merchandise, including livestock and equine feed and equipment, poultry, fencing, and sprayers and chemicals; food, treats, and equipment for dogs, cats, and other small animals, as well as dog wellness products; seasonal and recreation products comprising tractors and riders, lawn and garden, bird feeding, power equipment, and other recreational products; truck, tool, and hardware products, such as truck accessories, trailers, generators, lubricants, batteries, and hardware and tools; and clothing, gift, and décor products consist of clothing, footwear, toys, snacks, and decorative merchandise.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tractor Supply, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tractor Supply wasn't on the list.

While Tractor Supply currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.