Occidental Petroleum (NYSE:OXY - Get Free Report) had its price objective lifted by equities researchers at Truist Financial from $56.00 to $58.00 in a research report issued on Monday,Benzinga reports. The brokerage currently has a "hold" rating on the oil and gas producer's stock. Truist Financial's price target points to a potential upside of 9.97% from the stock's current price.

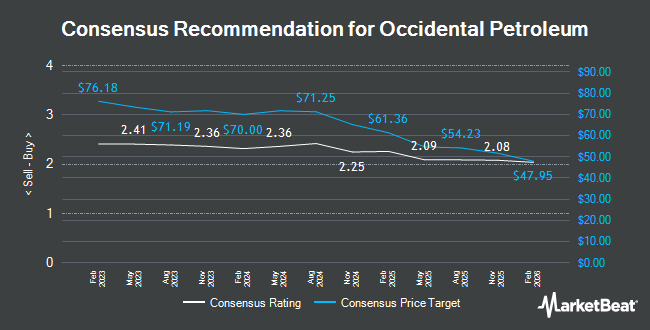

Several other equities analysts have also recently weighed in on OXY. TD Cowen cut their price target on Occidental Petroleum from $80.00 to $68.00 and set a "buy" rating for the company in a report on Tuesday, November 12th. Mizuho cut their target price on shares of Occidental Petroleum from $72.00 to $70.00 and set a "neutral" rating for the company in a report on Monday, December 16th. Wells Fargo & Company decreased their price target on shares of Occidental Petroleum from $56.00 to $53.00 and set an "equal weight" rating on the stock in a research note on Monday, December 9th. Raymond James lifted their price objective on shares of Occidental Petroleum from $77.00 to $78.00 and gave the stock a "strong-buy" rating in a research note on Thursday, November 21st. Finally, Stephens upped their target price on shares of Occidental Petroleum from $70.00 to $71.00 and gave the company an "overweight" rating in a research report on Wednesday, November 13th. One equities research analyst has rated the stock with a sell rating, fourteen have issued a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $62.19.

Read Our Latest Analysis on OXY

Occidental Petroleum Price Performance

NYSE OXY traded up $1.44 on Monday, reaching $52.74. The company had a trading volume of 13,889,112 shares, compared to its average volume of 10,666,530. The firm's 50 day moving average price is $49.59 and its 200 day moving average price is $53.69. Occidental Petroleum has a 12 month low of $45.17 and a 12 month high of $71.18. The stock has a market capitalization of $49.49 billion, a PE ratio of 13.73 and a beta of 1.57. The company has a quick ratio of 0.76, a current ratio of 1.00 and a debt-to-equity ratio of 0.96.

Insider Buying and Selling at Occidental Petroleum

In related news, major shareholder Berkshire Hathaway Inc acquired 2,477,362 shares of the firm's stock in a transaction that occurred on Tuesday, December 17th. The stock was purchased at an average cost of $46.25 per share, for a total transaction of $114,577,992.50. Following the purchase, the insider now directly owns 257,758,886 shares of the company's stock, valued at $11,921,348,477.50. This trade represents a 0.97 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which can be accessed through this link. 0.31% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the business. Fortitude Family Office LLC grew its holdings in shares of Occidental Petroleum by 160.0% in the third quarter. Fortitude Family Office LLC now owns 494 shares of the oil and gas producer's stock valued at $25,000 after purchasing an additional 304 shares during the period. Mizuho Securities Co. Ltd. purchased a new stake in shares of Occidental Petroleum during the 3rd quarter valued at approximately $32,000. Transamerica Financial Advisors Inc. acquired a new position in Occidental Petroleum in the third quarter valued at approximately $50,000. Exchange Traded Concepts LLC purchased a new position in Occidental Petroleum in the third quarter worth approximately $87,000. Finally, Kennebec Savings Bank acquired a new stake in Occidental Petroleum during the third quarter worth $93,000. Hedge funds and other institutional investors own 88.70% of the company's stock.

Occidental Petroleum Company Profile

(

Get Free Report)

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, and North Africa. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas.

Read More

Before you consider Occidental Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Occidental Petroleum wasn't on the list.

While Occidental Petroleum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.