Five9 (NASDAQ:FIVN - Get Free Report)'s stock had its "buy" rating reaffirmed by equities researchers at Truist Financial in a research note issued on Tuesday,Benzinga reports. They presently have a $65.00 target price on the software maker's stock. Truist Financial's price target suggests a potential upside of 52.12% from the company's current price.

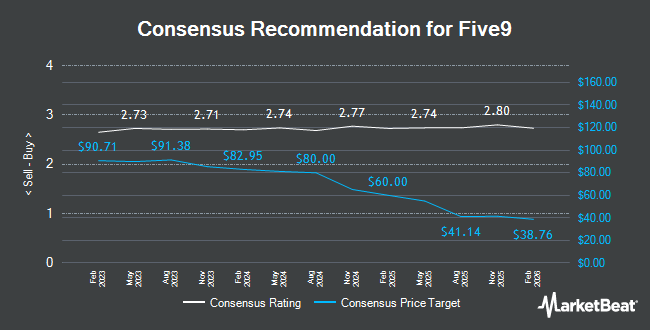

Other research analysts have also recently issued research reports about the company. Robert W. Baird raised their price target on Five9 from $40.00 to $43.00 and gave the stock a "neutral" rating in a research report on Monday, November 11th. Wells Fargo & Company lowered shares of Five9 from an "overweight" rating to an "equal weight" rating and decreased their target price for the company from $55.00 to $40.00 in a report on Tuesday, November 12th. Piper Sandler upped their price target on shares of Five9 from $35.00 to $46.00 and gave the stock an "overweight" rating in a report on Friday, November 8th. Morgan Stanley reduced their price target on shares of Five9 from $45.00 to $37.00 and set an "equal weight" rating on the stock in a research report on Tuesday, October 15th. Finally, Needham & Company LLC boosted their price objective on shares of Five9 from $48.00 to $52.00 and gave the company a "buy" rating in a research report on Monday. Six investment analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $57.65.

Get Our Latest Report on FIVN

Five9 Price Performance

Five9 stock traded up $0.12 during mid-day trading on Tuesday, reaching $42.73. 1,619,695 shares of the company were exchanged, compared to its average volume of 1,512,248. The firm has a market cap of $3.21 billion, a PE ratio of -86.24, a PEG ratio of 28.88 and a beta of 0.92. The company has a debt-to-equity ratio of 1.32, a current ratio of 1.85 and a quick ratio of 1.85. The company has a fifty day simple moving average of $35.80 and a 200-day simple moving average of $36.69. Five9 has a 12 month low of $26.60 and a 12 month high of $82.61.

Insider Activity at Five9

In other news, COO Andy Dignan sold 4,109 shares of the stock in a transaction dated Wednesday, December 4th. The stock was sold at an average price of $41.85, for a total value of $171,961.65. Following the completion of the sale, the chief operating officer now owns 115,818 shares of the company's stock, valued at approximately $4,846,983.30. This represents a 3.43 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, CAO Leena Mansharamani sold 1,346 shares of the firm's stock in a transaction dated Wednesday, December 4th. The stock was sold at an average price of $41.33, for a total value of $55,630.18. Following the transaction, the chief accounting officer now owns 35,526 shares of the company's stock, valued at $1,468,289.58. This trade represents a 3.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 29,004 shares of company stock worth $1,209,279 in the last quarter. 1.80% of the stock is owned by insiders.

Institutional Trading of Five9

A number of institutional investors and hedge funds have recently added to or reduced their stakes in FIVN. Rhumbline Advisers lifted its position in shares of Five9 by 0.8% in the 2nd quarter. Rhumbline Advisers now owns 86,000 shares of the software maker's stock worth $3,793,000 after purchasing an additional 673 shares during the period. Signaturefd LLC raised its stake in Five9 by 1,892.3% during the third quarter. Signaturefd LLC now owns 1,036 shares of the software maker's stock worth $30,000 after buying an additional 984 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund acquired a new position in Five9 in the second quarter valued at $57,000. Arizona State Retirement System boosted its position in Five9 by 8.9% during the second quarter. Arizona State Retirement System now owns 20,673 shares of the software maker's stock valued at $912,000 after acquiring an additional 1,693 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in Five9 by 13.4% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 19,069 shares of the software maker's stock worth $548,000 after acquiring an additional 2,254 shares during the period. Institutional investors and hedge funds own 96.64% of the company's stock.

Five9 Company Profile

(

Get Free Report)

Five9, Inc, together with its subsidiaries, provides intelligent cloud software for contact centers in the United States, India, and internationally. It offers a virtual contact center cloud platform that delivers a suite of applications, which enables the breadth of contact center-related customer service, sales, and marketing functions.

Recommended Stories

Before you consider Five9, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five9 wasn't on the list.

While Five9 currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.