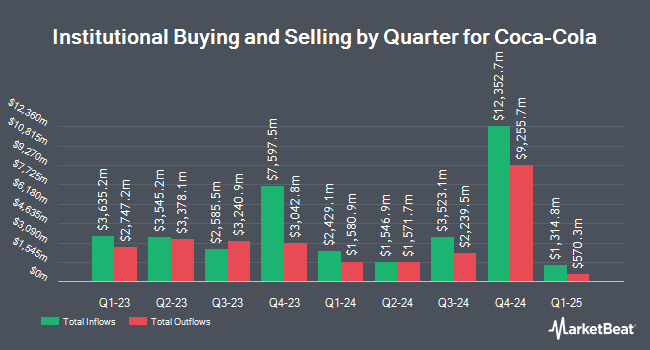

Trust Co. of Vermont decreased its position in The Coca-Cola Company (NYSE:KO - Free Report) by 13.2% during the 4th quarter, according to its most recent disclosure with the SEC. The fund owned 68,605 shares of the company's stock after selling 10,440 shares during the period. Trust Co. of Vermont's holdings in Coca-Cola were worth $4,271,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also recently made changes to their positions in KO. FMR LLC increased its position in shares of Coca-Cola by 13.7% in the third quarter. FMR LLC now owns 92,961,376 shares of the company's stock valued at $6,680,205,000 after acquiring an additional 11,206,995 shares during the period. Wellington Management Group LLP increased its holdings in Coca-Cola by 14.5% during the 3rd quarter. Wellington Management Group LLP now owns 31,615,428 shares of the company's stock valued at $2,271,885,000 after purchasing an additional 4,013,996 shares during the period. B. Metzler seel. Sohn & Co. Holding AG bought a new position in Coca-Cola during the 3rd quarter valued at approximately $269,382,000. Geode Capital Management LLC lifted its holdings in Coca-Cola by 3.3% in the 3rd quarter. Geode Capital Management LLC now owns 92,957,028 shares of the company's stock worth $6,664,005,000 after buying an additional 2,966,964 shares during the period. Finally, Pathway Financial Advisers LLC grew its position in shares of Coca-Cola by 7,006.8% in the 3rd quarter. Pathway Financial Advisers LLC now owns 2,478,487 shares of the company's stock worth $178,104,000 after buying an additional 2,443,612 shares during the last quarter. Institutional investors own 70.26% of the company's stock.

Coca-Cola Stock Up 0.8 %

NYSE:KO traded up $0.51 on Friday, reaching $62.76. 17,877,164 shares of the stock traded hands, compared to its average volume of 13,543,682. The company's fifty day simple moving average is $62.69 and its 200 day simple moving average is $66.40. The company has a market capitalization of $270.34 billion, a price-to-earnings ratio of 25.93, a PEG ratio of 3.35 and a beta of 0.61. The Coca-Cola Company has a 12 month low of $57.93 and a 12 month high of $73.53. The company has a current ratio of 1.06, a quick ratio of 0.90 and a debt-to-equity ratio of 1.53.

Coca-Cola (NYSE:KO - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The company reported $0.77 earnings per share for the quarter, topping analysts' consensus estimates of $0.74 by $0.03. Coca-Cola had a net margin of 22.45% and a return on equity of 44.01%. The company had revenue of $11.85 billion during the quarter, compared to analyst estimates of $11.61 billion. During the same period in the previous year, the business earned $0.74 EPS. The firm's revenue for the quarter was down .8% on a year-over-year basis. Equities analysts predict that The Coca-Cola Company will post 2.85 EPS for the current fiscal year.

Insider Buying and Selling

In other Coca-Cola news, CEO James Quincey sold 100,000 shares of Coca-Cola stock in a transaction that occurred on Friday, November 8th. The shares were sold at an average price of $64.03, for a total value of $6,403,000.00. Following the completion of the sale, the chief executive officer now owns 342,546 shares of the company's stock, valued at approximately $21,933,220.38. The trade was a 22.60 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 0.97% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on KO. Piper Sandler started coverage on Coca-Cola in a report on Tuesday, January 7th. They set an "overweight" rating and a $74.00 target price for the company. Deutsche Bank Aktiengesellschaft raised shares of Coca-Cola from a "hold" rating to a "buy" rating and raised their target price for the stock from $68.00 to $70.00 in a research report on Thursday, December 12th. UBS Group reduced their price target on shares of Coca-Cola from $82.00 to $72.00 and set a "buy" rating on the stock in a research report on Thursday. Wells Fargo & Company lowered their price objective on shares of Coca-Cola from $75.00 to $70.00 and set an "overweight" rating for the company in a report on Tuesday, January 7th. Finally, TD Cowen upgraded Coca-Cola from a "hold" rating to a "buy" rating and set a $75.00 target price on the stock in a report on Wednesday, January 8th. Two analysts have rated the stock with a hold rating, fifteen have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $72.13.

Read Our Latest Report on Coca-Cola

Coca-Cola Profile

(

Free Report)

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks, sparkling flavors; water, sports, coffee, and tea; juice, value-added dairy, and plant-based beverages; and other beverages. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores.

Featured Stories

Before you consider Coca-Cola, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola wasn't on the list.

While Coca-Cola currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.