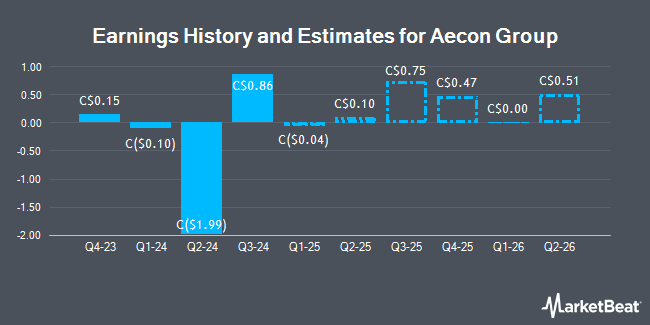

Aecon Group Inc. (TSE:ARE - Free Report) - Analysts at Desjardins lowered their FY2026 earnings per share estimates for shares of Aecon Group in a research report issued to clients and investors on Sunday, November 3rd. Desjardins analyst B. Poirier now forecasts that the company will post earnings per share of $2.31 for the year, down from their previous estimate of $2.46. The consensus estimate for Aecon Group's current full-year earnings is $1.38 per share.

Other equities analysts also recently issued reports about the company. Stifel Nicolaus increased their target price on Aecon Group from C$30.00 to C$31.00 in a research report on Friday, October 4th. Raymond James raised their target price on Aecon Group from C$24.00 to C$28.00 in a research note on Tuesday. National Bank Financial raised shares of Aecon Group from a "hold" rating to a "strong-buy" rating in a report on Sunday, July 28th. BMO Capital Markets increased their price objective on Aecon Group from C$16.50 to C$27.00 in a report on Monday. Finally, National Bankshares upgraded Aecon Group from a "sector perform" rating to an "outperform" rating and raised their price target for the company from C$17.00 to C$20.50 in a report on Monday, July 29th. Four analysts have rated the stock with a hold rating, seven have given a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, Aecon Group currently has a consensus rating of "Moderate Buy" and a consensus price target of C$25.94.

View Our Latest Stock Report on Aecon Group

Aecon Group Stock Performance

Shares of TSE:ARE traded up C$0.01 during trading on Tuesday, reaching C$28.60. 212,179 shares of the stock were exchanged, compared to its average volume of 293,945. The company has a current ratio of 1.35, a quick ratio of 1.27 and a debt-to-equity ratio of 32.86. The firm has a market cap of C$1.79 billion, a PE ratio of -105.89, a PEG ratio of 18.18 and a beta of 1.13. Aecon Group has a 12 month low of C$10.30 and a 12 month high of C$28.79. The stock has a 50-day moving average price of C$20.83 and a 200-day moving average price of C$17.95.

Aecon Group Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, October 2nd. Stockholders of record on Wednesday, October 2nd were paid a dividend of $0.19 per share. This represents a $0.76 annualized dividend and a dividend yield of 2.66%. The ex-dividend date of this dividend was Friday, September 20th. Aecon Group's dividend payout ratio (DPR) is currently -281.48%.

Insider Transactions at Aecon Group

In other Aecon Group news, Senior Officer Timothy John Murphy purchased 4,244 shares of Aecon Group stock in a transaction on Thursday, August 8th. The stock was bought at an average price of C$17.66 per share, for a total transaction of C$74,969.84. Corporate insiders own 0.82% of the company's stock.

About Aecon Group

(

Get Free Report)

Aecon Group Inc, together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally. It operates through two segments, Construction and Concessions. The Construction segment focuses on civil infrastructure, urban transportation solutions, nuclear power infrastructure, utility infrastructure, and conventional industrial infrastructure market sectors.

Read More

Before you consider Aecon Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aecon Group wasn't on the list.

While Aecon Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.