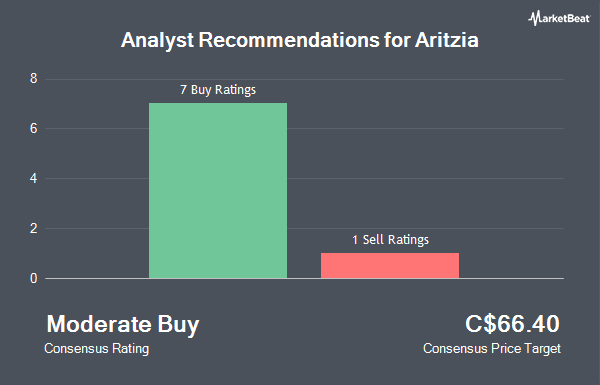

Shares of Aritzia Inc. (TSE:ATZ - Get Free Report) have been assigned a consensus rating of "Buy" from the seven analysts that are covering the firm, MarketBeat reports. Seven equities research analysts have rated the stock with a buy recommendation. The average twelve-month price target among brokerages that have issued a report on the stock in the last year is C$55.38.

A number of brokerages have issued reports on ATZ. TD Securities reduced their price objective on shares of Aritzia from C$60.00 to C$58.00 in a research report on Friday, October 11th. Raymond James raised their price objective on shares of Aritzia from C$43.00 to C$48.00 and gave the stock an "outperform" rating in a report on Monday, July 15th. CIBC lifted their price objective on Aritzia from C$47.00 to C$60.00 in a research report on Friday, October 11th. BMO Capital Markets increased their target price on Aritzia from C$52.00 to C$57.00 in a research report on Friday, October 11th. Finally, Canaccord Genuity Group lifted their price target on Aritzia from C$46.00 to C$52.00 and gave the company a "buy" rating in a research report on Monday, July 29th.

Read Our Latest Stock Analysis on ATZ

Aritzia Trading Up 1.7 %

Shares of Aritzia stock traded up C$0.77 during trading on Friday, reaching C$45.60. 430,100 shares of the stock were exchanged, compared to its average volume of 362,078. Aritzia has a 1 year low of C$20.81 and a 1 year high of C$51.80. The firm has a market cap of C$4.19 billion, a price-to-earnings ratio of 67.06, a price-to-earnings-growth ratio of 1.19 and a beta of 1.83. The company has a quick ratio of 0.19, a current ratio of 1.40 and a debt-to-equity ratio of 97.38. The stock's fifty day moving average is C$46.86 and its 200 day moving average is C$41.59.

Aritzia (TSE:ATZ - Get Free Report) last issued its quarterly earnings data on Thursday, October 10th. The company reported C$0.11 earnings per share for the quarter, missing analysts' consensus estimates of C$0.13 by C($0.02). Aritzia had a return on equity of 9.84% and a net margin of 3.26%. The business had revenue of C$615.66 million during the quarter, compared to the consensus estimate of C$581.10 million. As a group, equities research analysts expect that Aritzia will post 1.7771148 earnings per share for the current fiscal year.

Aritzia Company Profile

(

Get Free ReportAritzia Inc, together with its subsidiaries, designs, develops, and sells apparels and accessories for women in the United States and Canada. The company offers activewear, blazers and suiting, bodysuits, denim, dresses, jackets and coats, jumpsuits and rompers, leggings and bike shorts, pants, shirts and blouses, shorts, skirts, sweaters, and sweatpants, sweatshirts, hoodies, and sweats, as well as t-shirts, tops, intimates, bra tops, leaotards.

See Also

Before you consider Aritzia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aritzia wasn't on the list.

While Aritzia currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.