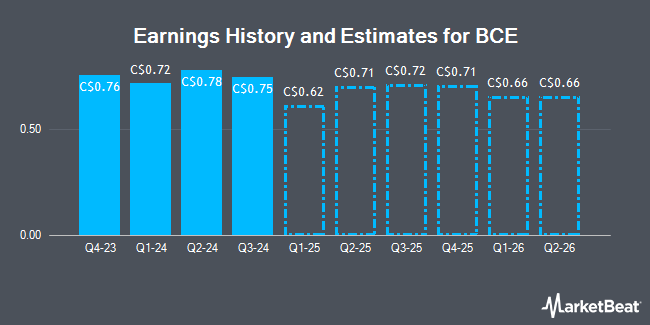

BCE Inc. (TSE:BCE - Free Report) NYSE: BCE - National Bank Financial increased their FY2025 earnings per share (EPS) estimates for BCE in a report released on Wednesday, September 18th. National Bank Financial analyst A. Shine now anticipates that the company will post earnings of $3.06 per share for the year, up from their previous forecast of $2.98. The consensus estimate for BCE's current full-year earnings is $2.99 per share.

BCE (TSE:BCE - Get Free Report) NYSE: BCE last issued its quarterly earnings data on Thursday, August 1st. The company reported C$0.78 earnings per share for the quarter, missing analysts' consensus estimates of C$0.80 by C($0.02). The company had revenue of C$6.01 billion for the quarter, compared to the consensus estimate of C$6.07 billion. BCE had a net margin of 8.75% and a return on equity of 10.63%.

BCE has been the subject of several other reports. Canaccord Genuity Group lifted their price objective on shares of BCE from C$50.00 to C$52.00 in a research note on Thursday. Royal Bank of Canada upped their target price on BCE from C$51.00 to C$53.00 in a research report on Thursday. JPMorgan Chase & Co. increased their price target on BCE from C$46.00 to C$47.00 and gave the stock a "neutral" rating in a research report on Friday, August 2nd. TD Securities lifted their target price on shares of BCE from C$47.00 to C$48.00 and gave the company a "hold" rating in a report on Monday, July 22nd. Finally, BMO Capital Markets upped their price target on BCE from C$48.00 to C$51.00 in a report on Thursday. Seven research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of C$51.17.

Read Our Latest Analysis on BCE

BCE Price Performance

BCE has a 52-week low of C$42.58 and a 52-week high of C$56.18. The stock has a fifty day simple moving average of C$46.95 and a two-hundred day simple moving average of C$46.16. The company has a debt-to-equity ratio of 197.43, a current ratio of 0.65 and a quick ratio of 0.43. The firm has a market cap of C$43.24 billion, a PE ratio of 22.12, a price-to-earnings-growth ratio of 1.90 and a beta of 0.48.

BCE Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, October 15th. Shareholders of record on Tuesday, October 15th will be paid a dividend of $0.998 per share. The ex-dividend date is Monday, September 16th. This represents a $3.99 annualized dividend and a dividend yield of ∞. BCE's dividend payout ratio is currently 185.58%.

BCE Company Profile

(

Get Free Report)

BCE Inc, a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through two segments, Bell Communication and Technology Services, and Bell Media. The Bell Communication and Technology Services segment provides wireless products and services including mobile data and voice plans and devices; wireline products and services comprising data, including internet access, internet protocol television, cloud-based services, and business solutions, as well as voice, and other communication services and products; and satellite TV and connectivity services for residential, small and medium-sized business, government, and large enterprise customers.

Recommended Stories

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.