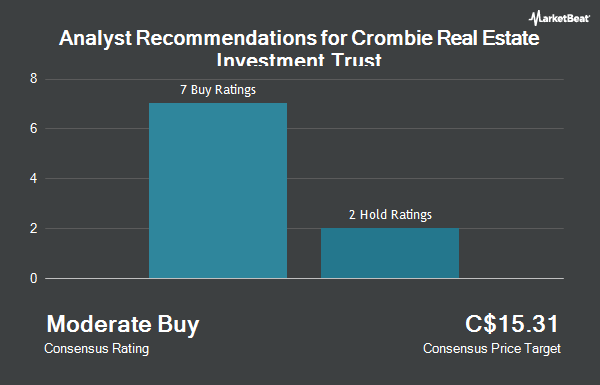

Crombie Real Estate Investment Trust (TSE:CRR.UN - Get Free Report) has received a consensus rating of "Moderate Buy" from the nine analysts that are currently covering the stock, Marketbeat Ratings reports. Two research analysts have rated the stock with a hold recommendation and seven have assigned a buy recommendation to the company. The average 1 year target price among analysts that have covered the stock in the last year is C$15.94.

A number of equities research analysts have recently commented on CRR.UN shares. TD Securities raised their price objective on shares of Crombie Real Estate Investment Trust from C$15.00 to C$16.00 and gave the stock a "buy" rating in a research note on Wednesday, September 4th. BMO Capital Markets increased their target price on shares of Crombie Real Estate Investment Trust from C$15.00 to C$16.00 in a research note on Monday. Canaccord Genuity Group lifted their price target on Crombie Real Estate Investment Trust from C$14.00 to C$15.00 and gave the company a "hold" rating in a research note on Monday, September 16th. Raymond James increased their price target on Crombie Real Estate Investment Trust from C$16.25 to C$16.75 in a research report on Friday, September 6th. Finally, National Bankshares raised their price objective on Crombie Real Estate Investment Trust from C$15.25 to C$17.00 in a report on Wednesday, October 9th.

View Our Latest Report on CRR.UN

Crombie Real Estate Investment Trust Stock Performance

Shares of Crombie Real Estate Investment Trust stock traded up C$0.09 on Monday, reaching C$15.30. 124,479 shares of the stock were exchanged, compared to its average volume of 173,175. The business has a 50 day moving average price of C$15.16 and a two-hundred day moving average price of C$13.77. The firm has a market capitalization of C$1.65 billion, a price-to-earnings ratio of -54.64 and a beta of 0.95. Crombie Real Estate Investment Trust has a twelve month low of C$11.91 and a twelve month high of C$16.22. The company has a quick ratio of 0.11, a current ratio of 0.14 and a debt-to-equity ratio of 120.87.

Crombie Real Estate Investment Trust Dividend Announcement

The company also recently disclosed a monthly dividend, which will be paid on Friday, November 15th. Investors of record on Friday, November 15th will be issued a $0.0742 dividend. The ex-dividend date is Thursday, October 31st. This represents a $0.89 annualized dividend and a dividend yield of 5.82%. Crombie Real Estate Investment Trust's dividend payout ratio is presently -317.86%.

Crombie Real Estate Investment Trust Company Profile

(

Get Free ReportCrombie Real Estate Investment Trust ("Crombie") is an unincorporated, open-ended real estate investment trust established under, and governed by, the laws of the Province of Ontario. Crombie is one of the country's leading national retail property landlords with a strategy to own, operate and develop a portfolio of high quality grocery and drug store anchored shopping centres, freestanding stores and mixed use developments primarily in Canada's top urban and suburban markets.

Featured Articles

Before you consider Crombie Real Estate Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crombie Real Estate Investment Trust wasn't on the list.

While Crombie Real Estate Investment Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.