goeasy (TSE:GSY - Get Free Report) was downgraded by research analysts at BMO Capital Markets from an "outperform" rating to a "market perform" rating in a research report issued to clients and investors on Tuesday, BayStreet.CA reports. They presently have a C$202.00 price target on the stock, down from their prior price target of C$218.00. BMO Capital Markets' target price points to a potential upside of 22.14% from the company's current price.

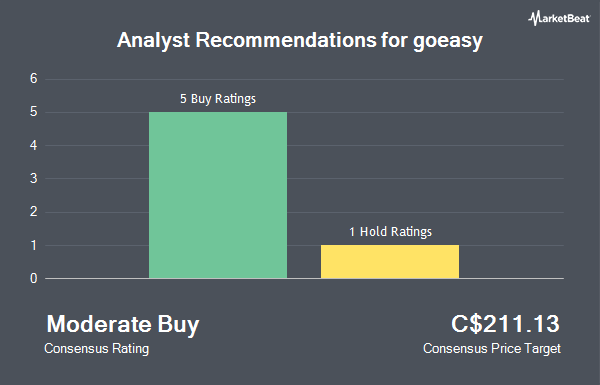

A number of other research analysts also recently issued reports on GSY. National Bankshares boosted their target price on shares of goeasy from C$210.00 to C$235.00 and gave the company an "outperform" rating in a research report on Monday, July 29th. Scotiabank upped their target price on goeasy from C$215.00 to C$222.00 in a research note on Friday, August 9th. Two investment analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to data from MarketBeat.com, goeasy has an average rating of "Moderate Buy" and an average price target of C$218.22.

Check Out Our Latest Stock Analysis on goeasy

goeasy Stock Performance

GSY stock traded down C$17.09 during trading on Tuesday, reaching C$165.39. The company had a trading volume of 289,570 shares, compared to its average volume of 47,632. The company has a debt-to-equity ratio of 289.31, a quick ratio of 28.46 and a current ratio of 15.97. goeasy has a twelve month low of C$106.43 and a twelve month high of C$206.02. The company has a market cap of C$2.78 billion, a price-to-earnings ratio of 10.83, a price-to-earnings-growth ratio of 0.84 and a beta of 1.87. The firm has a 50-day simple moving average of C$183.70 and a 200-day simple moving average of C$183.14.

goeasy (TSE:GSY - Get Free Report) last issued its earnings results on Thursday, August 8th. The company reported C$4.10 EPS for the quarter, beating analysts' consensus estimates of C$4.01 by C$0.09. goeasy had a return on equity of 25.28% and a net margin of 33.40%. The firm had revenue of C$377.80 million for the quarter, compared to analyst estimates of C$372.40 million. As a group, sell-side analysts expect that goeasy will post 20.3207343 earnings per share for the current year.

Insider Activity at goeasy

In other goeasy news, Senior Officer Jason Mullins sold 4,500 shares of the stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of C$188.00, for a total transaction of C$846,000.00. 22.05% of the stock is owned by corporate insiders.

goeasy Company Profile

(

Get Free Report)

goeasy Ltd. provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada. The company operates through two segments, Easyfinancial and Easyhome. It offers unsecured and secured installment loans; home equity secured instalment loans and automotive vehicle financing; and loans to finance the purchase of retail goods, powersports and recreational vehicles, home improvement projects, and healthcare related products and services.

Featured Articles

Before you consider goeasy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and goeasy wasn't on the list.

While goeasy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.