Parkland (TSE:PKI - Free Report) had its price target cut by ATB Capital from C$49.00 to C$46.00 in a research note released on Friday morning, BayStreet.CA reports. They currently have an outperform rating on the stock.

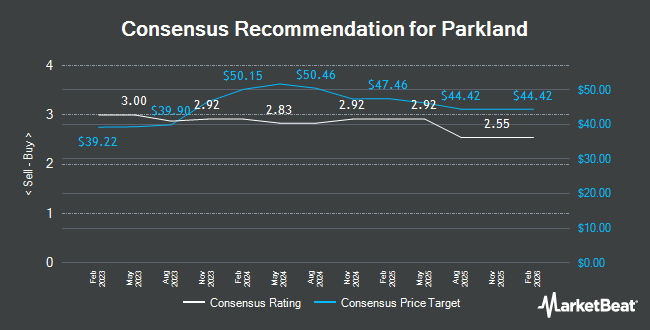

PKI has been the topic of a number of other reports. Desjardins dropped their price objective on Parkland from C$46.00 to C$44.00 and set a "buy" rating on the stock in a research note on Wednesday, October 23rd. Raymond James lowered their price target on Parkland from C$55.00 to C$47.00 in a research note on Friday, October 25th. TD Securities lowered their price target on Parkland from C$55.00 to C$53.00 and set a "buy" rating on the stock in a research note on Wednesday, October 16th. Royal Bank of Canada cut their target price on Parkland from C$49.00 to C$48.00 and set an "outperform" rating for the company in a research report on Friday, August 2nd. Finally, National Bankshares decreased their price target on Parkland from C$47.00 to C$45.00 and set a "buy" rating on the stock in a research note on Friday. One equities research analyst has rated the stock with a hold rating and ten have assigned a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of C$47.38.

Read Our Latest Stock Analysis on PKI

Parkland Stock Up 1.7 %

Shares of TSE:PKI traded up C$0.56 on Friday, reaching C$32.96. The company had a trading volume of 516,712 shares, compared to its average volume of 526,856. Parkland has a twelve month low of C$32.00 and a twelve month high of C$47.99. The stock has a 50-day moving average price of C$35.22 and a 200 day moving average price of C$37.68. The stock has a market capitalization of C$5.74 billion, a P/E ratio of 15.47, a P/E/G ratio of 11.79 and a beta of 1.33. The company has a quick ratio of 0.73, a current ratio of 1.33 and a debt-to-equity ratio of 206.76.

Parkland (TSE:PKI - Get Free Report) last posted its quarterly earnings data on Wednesday, July 31st. The company reported C$0.88 EPS for the quarter, topping analysts' consensus estimates of C$0.82 by C$0.06. The business had revenue of C$7.50 billion for the quarter, compared to analyst estimates of C$7.92 billion. Parkland had a return on equity of 12.26% and a net margin of 1.23%. On average, equities analysts expect that Parkland will post 3.6022267 EPS for the current year.

Parkland Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Friday, September 20th were paid a dividend of $0.35 per share. The ex-dividend date of this dividend was Thursday, September 19th. This represents a $1.40 annualized dividend and a dividend yield of 4.25%. Parkland's dividend payout ratio (DPR) is currently 65.73%.

Insider Activity

In other Parkland news, Senior Officer Marcel Teunissen acquired 1,000 shares of Parkland stock in a transaction on Tuesday, August 27th. The shares were purchased at an average cost of C$36.52 per share, with a total value of C$36,520.00. 20.51% of the stock is owned by insiders.

Parkland Company Profile

(

Get Free Report)

Parkland Corporation operates food and convenience stores in Canada, the United States, and internationally. The company's Canada segment owns, supplies, and supports a coast-to-coast network of retail gas stations, electronic vehicle charging stations, frozen food retail locations, convenience stores, cardlock sites, bulk fuel, propane, heating oil, lubricants, and other related services to commercial, industrial, and residential customers; transports and distributes fuel through ships, rail, and highway carriers; and stores fuel in terminals and other owned and leased facilities, as well as engages in the low-carbon activities.

Recommended Stories

Before you consider Parkland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parkland wasn't on the list.

While Parkland currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.