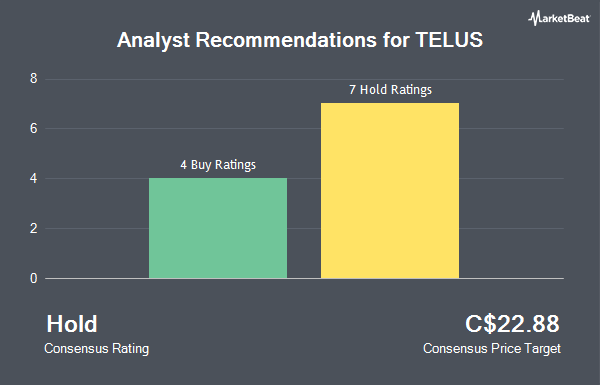

Shares of TELUS Co. (TSE:T - Get Free Report) NYSE: TU have been assigned an average recommendation of "Moderate Buy" from the ten analysts that are covering the company, Marketbeat reports. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and seven have assigned a buy rating to the company. The average 12 month price target among brokerages that have updated their coverage on the stock in the last year is C$24.54.

A number of brokerages have recently issued reports on T. JPMorgan Chase & Co. cut their price objective on shares of TELUS from C$24.00 to C$23.00 and set a "neutral" rating on the stock in a research report on Wednesday, July 10th. Barclays lowered their target price on shares of TELUS from C$24.00 to C$23.00 in a research note on Wednesday, October 9th. Scotiabank upgraded shares of TELUS from a "sector perform" rating to an "outperform" rating in a research note on Monday. CIBC lowered their target price on shares of TELUS from C$25.00 to C$24.00 and set an "outperform" rating for the company in a research note on Tuesday, August 6th. Finally, TD Securities lowered their target price on shares of TELUS from C$26.00 to C$25.00 and set a "buy" rating for the company in a research note on Wednesday, August 7th.

View Our Latest Report on TELUS

Insider Transactions at TELUS

In other TELUS news, Director Marc Parent bought 10,530 shares of the company's stock in a transaction dated Monday, August 12th. The stock was acquired at an average price of C$22.52 per share, with a total value of C$237,135.60. Insiders own 0.02% of the company's stock.

TELUS Stock Down 0.5 %

Shares of TSE T traded down C$0.11 during mid-day trading on Friday, reaching C$21.90. 2,999,345 shares of the company were exchanged, compared to its average volume of 3,247,636. TELUS has a 1 year low of C$20.04 and a 1 year high of C$25.94. The firm has a 50-day moving average of C$22.33 and a 200 day moving average of C$22.07. The stock has a market cap of C$32.41 billion, a price-to-earnings ratio of 41.51, a P/E/G ratio of 1.65 and a beta of 0.72. The company has a quick ratio of 0.52, a current ratio of 0.66 and a debt-to-equity ratio of 171.58.

TELUS (TSE:T - Get Free Report) NYSE: TU last issued its quarterly earnings data on Friday, August 2nd. The company reported C$0.25 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of C$0.24 by C$0.01. TELUS had a net margin of 3.91% and a return on equity of 4.67%. The firm had revenue of C$4.97 billion for the quarter, compared to the consensus estimate of C$5.04 billion. On average, research analysts expect that TELUS will post 1.2267985 earnings per share for the current year.

About TELUS

(

Get Free ReportTELUS Corporation, together with its subsidiaries, provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally-Led Customer Experiences segments. The Technology Solutions segment offers a range of telecommunications products and services; network services; healthcare services; mobile technologies equipment; data services, such as internet protocol; television; hosting, managed information technology, and cloud-based services; software, data management, and data analytics-driven smart food-chain and consumer goods technologies; home and business security; healthcare software and technology solutions; and voice and other telecommunications services, as well as mobile and fixed voice and data telecommunications services and products.

Featured Articles

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.