Desjardins set a C$15.50 target price on TransAlta (TSE:TA - Free Report) NYSE: TAC in a research note published on Wednesday morning, BayStreet.CA reports. The brokerage currently has a buy rating on the stock.

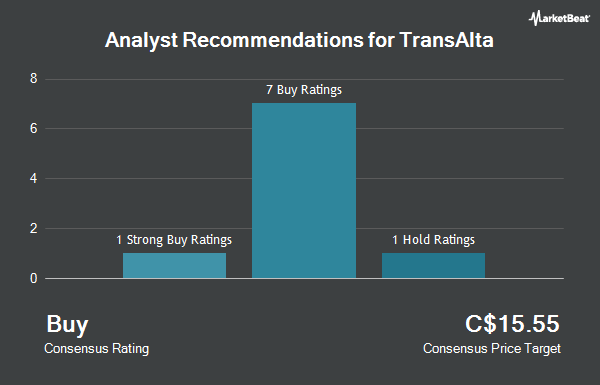

Several other brokerages also recently commented on TA. CIBC reduced their target price on TransAlta from C$16.50 to C$15.50 and set an "outperform" rating for the company in a research note on Monday, July 22nd. BMO Capital Markets boosted their price target on TransAlta from C$16.00 to C$17.00 in a research note on Thursday, September 5th. TD Securities boosted their target price on shares of TransAlta from C$14.00 to C$16.00 and gave the company a "buy" rating in a research report on Tuesday. Finally, National Bankshares raised their price target on shares of TransAlta from C$14.00 to C$15.00 and gave the stock an "outperform" rating in a research report on Friday, August 23rd. Six research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock presently has a consensus rating of "Buy" and an average target price of C$15.50.

Read Our Latest Report on TA

TransAlta Trading Up 3.9 %

Shares of TA traded up C$0.55 on Wednesday, reaching C$14.60. 2,004,006 shares of the company's stock were exchanged, compared to its average volume of 1,030,367. The business has a 50 day moving average price of C$13.08 and a two-hundred day moving average price of C$10.90. The stock has a market capitalization of C$4.35 billion, a P/E ratio of 7.62, a price-to-earnings-growth ratio of -0.07 and a beta of 0.93. The company has a current ratio of 0.84, a quick ratio of 0.62 and a debt-to-equity ratio of 219.87. TransAlta has a 12 month low of C$8.22 and a 12 month high of C$14.73.

TransAlta (TSE:TA - Get Free Report) NYSE: TAC last announced its quarterly earnings results on Thursday, August 1st. The company reported C$0.18 earnings per share (EPS) for the quarter, topping the consensus estimate of C$0.07 by C$0.11. TransAlta had a return on equity of 32.01% and a net margin of 19.50%. The company had revenue of C$582.00 million during the quarter.

TransAlta Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Sunday, December 1st will be paid a $0.06 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $0.24 annualized dividend and a dividend yield of 1.64%. TransAlta's payout ratio is 12.63%.

Insider Buying and Selling at TransAlta

In other news, Senior Officer Jane Nyla Fedoretz sold 20,000 shares of the stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of C$13.92, for a total value of C$278,400.00. In related news, Senior Officer Jane Nyla Fedoretz sold 20,000 shares of the business's stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of C$13.92, for a total value of C$278,400.00. Also, Senior Officer Kerry Lynn O'reilly sold 48,833 shares of the stock in a transaction on Friday, August 9th. The shares were sold at an average price of C$10.99, for a total value of C$536,674.67. Insiders have sold a total of 120,217 shares of company stock worth $1,397,220 over the last 90 days. Insiders own 0.21% of the company's stock.

About TransAlta

(

Get Free Report)

TransAlta Corporation engages in the development, production, and sale of electric energy. It operates through Hydro, Wind and Solar, Gas, Energy Transition, and Energy Marketing segments. The Hydro segment holds interest of approximately 922 megawatts (MW) of owned hydroelectric generating capacity located in Alberta, British Columbia, and Ontario.

Further Reading

Before you consider TransAlta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransAlta wasn't on the list.

While TransAlta currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.