TT International Asset Management LTD increased its holdings in ASE Technology Holding Co., Ltd. (NYSE:ASX - Free Report) by 14.8% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 2,063,535 shares of the semiconductor company's stock after buying an additional 265,767 shares during the period. ASE Technology comprises about 2.5% of TT International Asset Management LTD's holdings, making the stock its 15th largest position. TT International Asset Management LTD owned about 0.09% of ASE Technology worth $20,140,000 at the end of the most recent quarter.

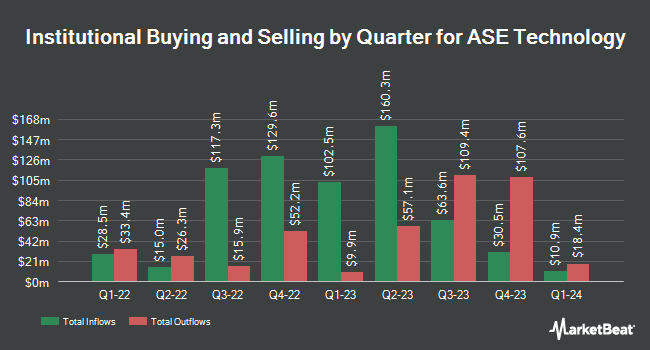

Several other institutional investors and hedge funds have also made changes to their positions in ASX. Fisher Asset Management LLC boosted its stake in shares of ASE Technology by 10.8% during the 3rd quarter. Fisher Asset Management LLC now owns 15,167,615 shares of the semiconductor company's stock worth $148,036,000 after purchasing an additional 1,481,424 shares during the last quarter. Driehaus Capital Management LLC boosted its position in shares of ASE Technology by 105.3% in the second quarter. Driehaus Capital Management LLC now owns 982,028 shares of the semiconductor company's stock worth $11,215,000 after acquiring an additional 503,765 shares during the last quarter. Squarepoint Ops LLC boosted its position in shares of ASE Technology by 528.5% in the second quarter. Squarepoint Ops LLC now owns 478,766 shares of the semiconductor company's stock worth $5,468,000 after acquiring an additional 402,585 shares during the last quarter. Citigroup Inc. raised its holdings in ASE Technology by 9.7% in the third quarter. Citigroup Inc. now owns 4,323,059 shares of the semiconductor company's stock valued at $42,193,000 after buying an additional 382,425 shares during the period. Finally, Earnest Partners LLC raised its holdings in ASE Technology by 10.4% in the second quarter. Earnest Partners LLC now owns 2,840,090 shares of the semiconductor company's stock valued at $32,434,000 after buying an additional 266,991 shares during the period. 6.80% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of analysts have recently issued reports on the stock. StockNews.com lowered shares of ASE Technology from a "buy" rating to a "hold" rating in a research note on Friday, September 20th. Morgan Stanley raised shares of ASE Technology from an "equal weight" rating to an "overweight" rating in a report on Monday, September 16th. Finally, UBS Group raised shares of ASE Technology from a "neutral" rating to a "buy" rating in a report on Tuesday, October 15th.

View Our Latest Research Report on ASX

ASE Technology Stock Performance

Shares of NYSE ASX traded up $0.20 during midday trading on Wednesday, reaching $10.01. 2,199,295 shares of the company traded hands, compared to its average volume of 6,816,914. The company has a debt-to-equity ratio of 0.38, a current ratio of 1.18 and a quick ratio of 0.89. The stock has a 50-day moving average price of $9.91 and a 200 day moving average price of $10.27. ASE Technology Holding Co., Ltd. has a 52 week low of $8.10 and a 52 week high of $12.86. The company has a market cap of $21.97 billion, a price-to-earnings ratio of 21.87, a PEG ratio of 0.72 and a beta of 1.21.

ASE Technology (NYSE:ASX - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The semiconductor company reported $0.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.15 by ($0.02). ASE Technology had a return on equity of 10.05% and a net margin of 5.47%. The company had revenue of $4.96 billion for the quarter. During the same quarter in the previous year, the firm posted $0.13 EPS. Sell-side analysts anticipate that ASE Technology Holding Co., Ltd. will post 0.48 earnings per share for the current fiscal year.

About ASE Technology

(

Free Report)

ASE Technology Holding Co, Ltd., together with its subsidiaries, provides semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, Asia, Europe, and internationally. It develops, constructs, sells, leases, and manages real estate properties; produces substrates; offers information software, equipment leasing, investment advisory, and warehousing management services; commercial complex, after-sales, and support services; manages parking lot services; processes and sells computer and communication peripherals, electronic components, telecommunications equipment, and motherboards; and imports and exports goods and technology.

Further Reading

Before you consider ASE Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASE Technology wasn't on the list.

While ASE Technology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.