TT International Asset Management LTD boosted its stake in shares of TopBuild Corp. (NYSE:BLD - Free Report) by 199.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 14,087 shares of the construction company's stock after buying an additional 9,383 shares during the quarter. TopBuild accounts for approximately 0.7% of TT International Asset Management LTD's portfolio, making the stock its 22nd largest holding. TT International Asset Management LTD's holdings in TopBuild were worth $5,730,000 at the end of the most recent reporting period.

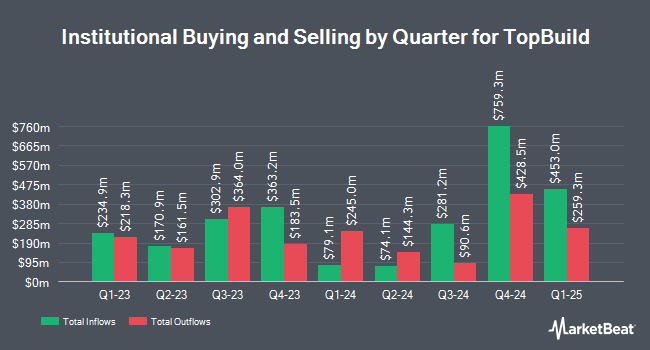

Several other large investors have also modified their holdings of BLD. Pitcairn Co. increased its stake in shares of TopBuild by 178.2% during the 3rd quarter. Pitcairn Co. now owns 2,220 shares of the construction company's stock worth $903,000 after purchasing an additional 1,422 shares in the last quarter. Nisa Investment Advisors LLC grew its stake in TopBuild by 6.1% in the 2nd quarter. Nisa Investment Advisors LLC now owns 14,258 shares of the construction company's stock worth $5,493,000 after acquiring an additional 820 shares during the period. Icon Wealth Advisors LLC grew its stake in TopBuild by 704.6% in the 3rd quarter. Icon Wealth Advisors LLC now owns 2,293 shares of the construction company's stock worth $933,000 after acquiring an additional 2,008 shares during the period. Massachusetts Financial Services Co. MA grew its stake in TopBuild by 37.3% in the 3rd quarter. Massachusetts Financial Services Co. MA now owns 178,824 shares of the construction company's stock worth $72,747,000 after acquiring an additional 48,562 shares during the period. Finally, Bank of Montreal Can grew its stake in TopBuild by 72.0% in the 3rd quarter. Bank of Montreal Can now owns 11,239 shares of the construction company's stock worth $4,600,000 after acquiring an additional 4,703 shares during the period. 95.67% of the stock is currently owned by institutional investors and hedge funds.

TopBuild Stock Up 0.3 %

Shares of BLD traded up $1.23 during midday trading on Wednesday, hitting $367.87. The company had a trading volume of 88,096 shares, compared to its average volume of 286,930. The company's 50 day moving average price is $377.88 and its 200 day moving average price is $394.03. The stock has a market cap of $10.85 billion, a price-to-earnings ratio of 18.48, a PEG ratio of 2.37 and a beta of 1.79. TopBuild Corp. has a 52 week low of $317.72 and a 52 week high of $495.68. The company has a quick ratio of 1.49, a current ratio of 2.01 and a debt-to-equity ratio of 0.64.

TopBuild (NYSE:BLD - Get Free Report) last released its earnings results on Tuesday, November 5th. The construction company reported $5.68 earnings per share for the quarter, topping the consensus estimate of $5.62 by $0.06. TopBuild had a net margin of 11.66% and a return on equity of 26.40%. The company had revenue of $1.37 billion during the quarter, compared to the consensus estimate of $1.39 billion. During the same quarter in the previous year, the firm earned $5.43 EPS. The company's revenue was up 3.6% on a year-over-year basis. On average, equities research analysts predict that TopBuild Corp. will post 20.95 EPS for the current year.

Wall Street Analyst Weigh In

Several analysts have commented on BLD shares. DA Davidson lowered their target price on shares of TopBuild from $460.00 to $450.00 and set a "buy" rating for the company in a research note on Thursday, November 7th. Evercore ISI decreased their price target on shares of TopBuild from $491.00 to $443.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. StockNews.com upgraded shares of TopBuild from a "hold" rating to a "buy" rating in a report on Tuesday, October 29th. Finally, Jefferies Financial Group decreased their price target on shares of TopBuild from $525.00 to $515.00 and set a "buy" rating on the stock in a report on Wednesday, October 9th. Two analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $440.44.

View Our Latest Research Report on BLD

About TopBuild

(

Free Report)

TopBuild Corp., together with its subsidiaries, engages in the installation and distribution of insulation and other building material products to the construction industry. The company operates in two segments, Installation and Specialty Distribution. It provides insulation products and accessories, glass and windows, rain gutters, garage doors, fireplaces, roofing materials, closet shelving, and other products.

Further Reading

Before you consider TopBuild, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TopBuild wasn't on the list.

While TopBuild currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.