TT International Asset Management LTD purchased a new stake in Credicorp Ltd. (NYSE:BAP - Free Report) in the third quarter, according to the company in its most recent filing with the SEC. The firm purchased 138,593 shares of the bank's stock, valued at approximately $25,081,000. Credicorp makes up about 3.1% of TT International Asset Management LTD's investment portfolio, making the stock its 10th biggest holding.

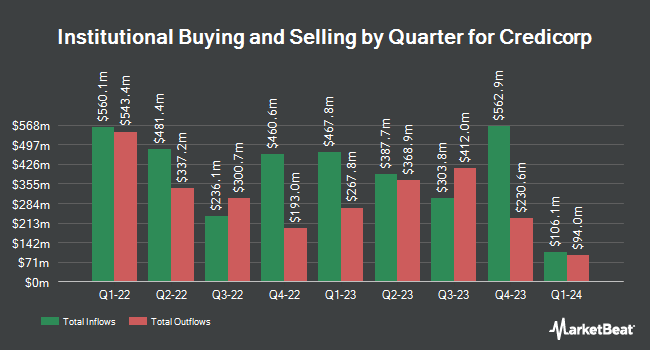

A number of other large investors have also made changes to their positions in BAP. Brown Brothers Harriman & Co. bought a new position in shares of Credicorp during the third quarter worth about $58,000. Headlands Technologies LLC bought a new position in shares of Credicorp in the second quarter valued at approximately $84,000. Atlas Capital Advisors LLC grew its stake in shares of Credicorp by 14.9% in the second quarter. Atlas Capital Advisors LLC now owns 687 shares of the bank's stock worth $111,000 after acquiring an additional 89 shares during the last quarter. Sanctuary Advisors LLC acquired a new stake in shares of Credicorp in the 2nd quarter valued at $210,000. Finally, Dynamic Advisor Solutions LLC acquired a new stake in shares of Credicorp in the 3rd quarter valued at $216,000. Hedge funds and other institutional investors own 89.81% of the company's stock.

Credicorp Stock Up 1.3 %

BAP stock traded up $2.50 during midday trading on Wednesday, hitting $193.50. The stock had a trading volume of 118,012 shares, compared to its average volume of 233,333. The firm has a market cap of $15.39 billion, a price-to-earnings ratio of 10.97, a price-to-earnings-growth ratio of 0.65 and a beta of 1.13. The business has a 50-day moving average of $187.71 and a two-hundred day moving average of $174.91. Credicorp Ltd. has a 52-week low of $123.80 and a 52-week high of $200.00. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.07 and a quick ratio of 1.07.

Credicorp Cuts Dividend

The company also recently declared an annual dividend, which was paid on Friday, October 18th. Investors of record on Monday, September 23rd were paid a dividend of $2.9084 per share. This represents a yield of 3.8%. The ex-dividend date was Monday, September 23rd. Credicorp's payout ratio is presently 53.24%.

Analyst Upgrades and Downgrades

Several brokerages have weighed in on BAP. JPMorgan Chase & Co. boosted their price objective on Credicorp from $200.00 to $219.00 and gave the stock an "overweight" rating in a report on Tuesday, November 12th. The Goldman Sachs Group lifted their target price on Credicorp from $143.00 to $160.00 and gave the company a "sell" rating in a research report on Tuesday, October 8th.

View Our Latest Research Report on Credicorp

Credicorp Company Profile

(

Free Report)

Credicorp Ltd. provides various financial, insurance, and health services and products primarily in Peru and internationally. It operates through Universal Banking, Insurance and Pensions, Microfinance, and Investment Banking and Equity Management segments. The Universal Banking segment grants various credits and financial instruments to individuals and legal entities; and various deposits and current accounts.

Featured Stories

Before you consider Credicorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credicorp wasn't on the list.

While Credicorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.