Tumwater Wealth Management LLC bought a new position in shares of Keysight Technologies, Inc. (NYSE:KEYS - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 1,973 shares of the scientific and technical instruments company's stock, valued at approximately $317,000. Keysight Technologies comprises 0.2% of Tumwater Wealth Management LLC's investment portfolio, making the stock its 24th largest position.

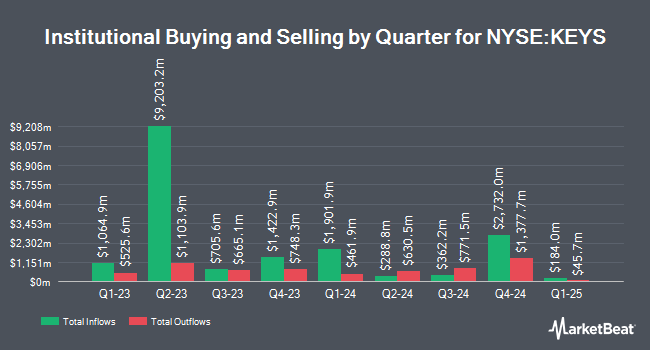

A number of other institutional investors have also made changes to their positions in KEYS. Madison Investment Advisors LLC acquired a new position in shares of Keysight Technologies in the 4th quarter valued at $88,166,000. Los Angeles Capital Management LLC lifted its holdings in Keysight Technologies by 330.3% during the fourth quarter. Los Angeles Capital Management LLC now owns 673,872 shares of the scientific and technical instruments company's stock worth $108,244,000 after acquiring an additional 517,267 shares in the last quarter. ANTIPODES PARTNERS Ltd grew its stake in Keysight Technologies by 282.4% in the fourth quarter. ANTIPODES PARTNERS Ltd now owns 626,145 shares of the scientific and technical instruments company's stock valued at $100,586,000 after acquiring an additional 462,403 shares during the period. Raymond James Financial Inc. bought a new stake in shares of Keysight Technologies in the fourth quarter worth about $58,367,000. Finally, Geode Capital Management LLC raised its position in shares of Keysight Technologies by 7.9% during the third quarter. Geode Capital Management LLC now owns 4,400,035 shares of the scientific and technical instruments company's stock worth $697,411,000 after purchasing an additional 323,235 shares during the period. 84.58% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, SVP Mark Adam Wallace sold 6,000 shares of the business's stock in a transaction dated Monday, December 30th. The shares were sold at an average price of $161.79, for a total transaction of $970,740.00. Following the transaction, the senior vice president now directly owns 85,829 shares in the company, valued at $13,886,273.91. The trade was a 6.53 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 0.61% of the company's stock.

Keysight Technologies Stock Down 0.2 %

Shares of NYSE:KEYS traded down $0.32 during midday trading on Thursday, reaching $155.16. The company had a trading volume of 714,414 shares, compared to its average volume of 1,107,389. The business's 50 day moving average price is $167.24 and its 200 day moving average price is $161.99. Keysight Technologies, Inc. has a 1-year low of $119.72 and a 1-year high of $186.20. The company has a quick ratio of 2.27, a current ratio of 2.98 and a debt-to-equity ratio of 0.35. The stock has a market cap of $26.81 billion, a PE ratio of 44.33, a P/E/G ratio of 2.41 and a beta of 1.10.

Analysts Set New Price Targets

A number of analysts recently issued reports on the company. Susquehanna reissued a "positive" rating and set a $185.00 target price on shares of Keysight Technologies in a research note on Wednesday, November 20th. StockNews.com cut shares of Keysight Technologies from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, March 11th. Barclays increased their target price on Keysight Technologies from $180.00 to $200.00 and gave the stock an "overweight" rating in a report on Wednesday, November 20th. Deutsche Bank Aktiengesellschaft boosted their price target on Keysight Technologies from $175.00 to $180.00 and gave the company a "buy" rating in a report on Wednesday, November 20th. Finally, Wells Fargo & Company upped their price objective on Keysight Technologies from $180.00 to $190.00 and gave the stock an "overweight" rating in a research report on Wednesday, February 26th. One equities research analyst has rated the stock with a sell rating and nine have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $184.44.

Read Our Latest Research Report on KEYS

Keysight Technologies Company Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Featured Articles

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.