Turim 21 Investimentos Ltda. acquired a new stake in Grupo Supervielle S.A. (NYSE:SUPV - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm acquired 21,153 shares of the company's stock, valued at approximately $348,000. Grupo Supervielle makes up 0.1% of Turim 21 Investimentos Ltda.'s portfolio, making the stock its 27th largest holding.

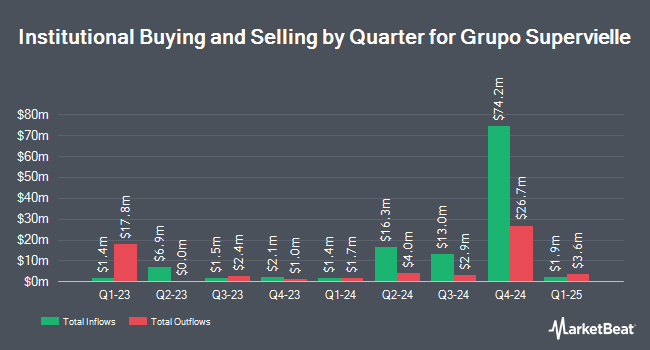

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. TT International Asset Management LTD increased its stake in shares of Grupo Supervielle by 539.9% in the fourth quarter. TT International Asset Management LTD now owns 116,086 shares of the company's stock worth $1,754,000 after purchasing an additional 97,946 shares during the period. Jane Street Group LLC bought a new position in Grupo Supervielle in the 3rd quarter worth approximately $749,000. Koshinski Asset Management Inc. bought a new stake in shares of Grupo Supervielle in the fourth quarter valued at approximately $289,000. JPMorgan Chase & Co. grew its stake in shares of Grupo Supervielle by 129.3% in the third quarter. JPMorgan Chase & Co. now owns 374,515 shares of the company's stock worth $2,663,000 after acquiring an additional 211,166 shares during the last quarter. Finally, Sparta 24 Ltd. bought a new position in Grupo Supervielle during the fourth quarter worth $2,192,000.

Grupo Supervielle Price Performance

Shares of NYSE:SUPV traded up $0.03 during trading on Friday, reaching $15.81. The stock had a trading volume of 855,582 shares, compared to its average volume of 1,224,009. The stock has a market capitalization of $1.40 billion, a PE ratio of 21.95 and a beta of 1.80. The company has a debt-to-equity ratio of 0.07, a current ratio of 0.86 and a quick ratio of 0.86. Grupo Supervielle S.A. has a 52 week low of $5.00 and a 52 week high of $19.75. The business's 50-day moving average price is $13.67 and its 200 day moving average price is $13.32.

Wall Street Analysts Forecast Growth

Separately, StockNews.com upgraded shares of Grupo Supervielle from a "sell" rating to a "hold" rating in a research note on Sunday, April 6th.

Get Our Latest Stock Report on SUPV

Grupo Supervielle Company Profile

(

Free Report)

Grupo Supervielle SA, a financial services holding company, provides various banking products and services in Argentina. The company operates through Personal & Business Banking, Corporate Banking, Bank Treasury, Consumer Finance, Insurance, and Asset Management and Other Services segments. It offers savings accounts, time and demand deposits, and checking accounts; various loan products, including personal, consumer, mortgage, unsecured, and car loans; overdrafts; loans with special facilities for project and working capital financing; and leasing, bank guarantees for tenants, salary advances, domestic and international factoring, international guarantees and letters of credit, payroll payment plans, credit and debit cards, and senior citizens benefit payment services, as well as financial services and investments, such as mutual funds and guarantees.

See Also

Before you consider Grupo Supervielle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grupo Supervielle wasn't on the list.

While Grupo Supervielle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.