Tutor Perini (NYSE:TPC - Get Free Report) is expected to be announcing its earnings results before the market opens on Thursday, April 24th. Analysts expect the company to announce earnings of $0.06 per share and revenue of $1.07 billion for the quarter. Tutor Perini has set its FY 2025 guidance at 1.500-1.900 EPS.

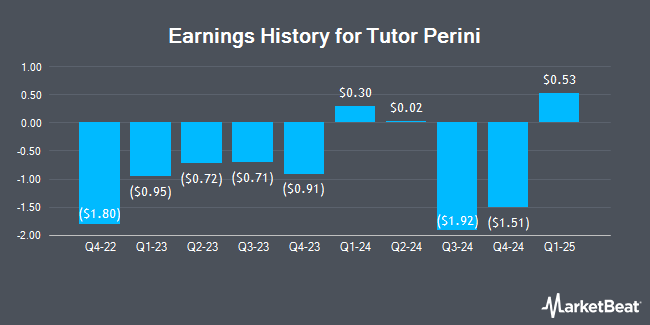

Tutor Perini (NYSE:TPC - Get Free Report) last issued its quarterly earnings data on Thursday, February 27th. The construction company reported ($1.51) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.29 by ($1.80). Tutor Perini had a negative net margin of 3.08% and a negative return on equity of 9.56%. The company had revenue of $1.07 billion for the quarter, compared to the consensus estimate of $1.08 billion. During the same period in the previous year, the business posted ($0.91) earnings per share.

Tutor Perini Price Performance

Shares of NYSE:TPC traded down $0.63 during trading on Friday, reaching $21.12. The stock had a trading volume of 1,513,546 shares, compared to its average volume of 530,641. The stock has a market capitalization of $1.11 billion, a PE ratio of -8.41 and a beta of 1.47. The company has a debt-to-equity ratio of 0.53, a current ratio of 1.55 and a quick ratio of 1.55. Tutor Perini has a 52 week low of $13.15 and a 52 week high of $34.55. The business's 50-day moving average price is $23.45 and its 200 day moving average price is $25.26.

Analysts Set New Price Targets

Several analysts have recently commented on the company. StockNews.com cut Tutor Perini from a "buy" rating to a "hold" rating in a report on Tuesday, January 28th. B. Riley upgraded Tutor Perini to a "strong-buy" rating in a research report on Tuesday, March 18th.

Read Our Latest Stock Analysis on Tutor Perini

Tutor Perini Company Profile

(

Get Free Report)

Tutor Perini Corporation, a construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies in the United States and internationally. It operates through three segments: Civil, Building, and Specialty Contractors.

Featured Stories

Before you consider Tutor Perini, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tutor Perini wasn't on the list.

While Tutor Perini currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.